What You Need to Know About Stamp Duty in the UK

Introduction

Stamp duty is a vital aspect of property transactions in the United Kingdom, influencing both buyers and the housing market significantly. As one of the essential costs associated with purchasing a property, understanding stamp duty’s implications is crucial for prospective homeowners and investors alike. Recent changes in legislation and market conditions have rendered its study even more relevant, especially for first-time buyers navigating the complexities of property ownership.

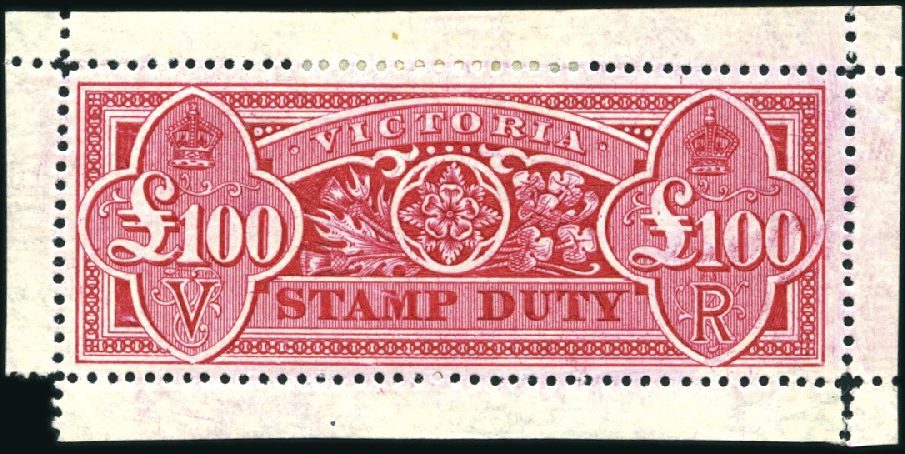

What is Stamp Duty?

Stamp duty, formally known as Stamp Duty Land Tax (SDLT) in England and Northern Ireland, is a tax levied on the purchase of land and buildings. The amount owed varies depending on the property’s purchase price, and in Scotland, it is referred to as Land and Buildings Transaction Tax (LBTT). In Wales, it is known as Land Transaction Tax (LTT). As of 2023, the SDLT rates start from 0% for properties costing up to £250,000, with rates increasing incrementally for properties priced above this threshold.

Recent Changes and Current Trends

In response to the COVID-19 pandemic, the UK government introduced temporary measures, including a stamp duty holiday that encouraged home buying and stimulated the housing market. This holiday ceased in September 2021, and since then, the landscape has evolved, with many buyers feeling the pinch as they contend with rising interest rates and inflation. Additionally, stamp duty thresholds were increased, giving some relief to first-time buyers and those purchasing lower-priced homes, but the financial pressure remains for others in the property ladder.

Stamp Duty and the Housing Market

The implications of stamp duty extend beyond individual buyers to influence the broader housing market. Elevated stamp duty rates can deter potential buyers, leading to decreased demand and affecting property prices. Conversely, incentives and reduced rates can lead to ephemeral spikes in market activity, as seen during the stamp duty holiday period. Current reports indicate a mixed trend: while some regions report a slowdown due to increased costs, others, particularly in highly sought-after areas, continue to experience robust demand.

Conclusion

As potential buyers navigate the intricacies of property purchasing, understanding stamp duty is essential to make informed financial decisions. With ongoing discussions regarding further reforms and the potential for future adjustments to tax thresholds, it remains a significant consideration for anyone looking to invest in real estate. Ongoing government reviews could reshape the landscape of stamp duty in the coming years, highlighting its importance in both personal finance and the UK housing market as a whole.