What You Need to Know About Bear Markets

Introduction

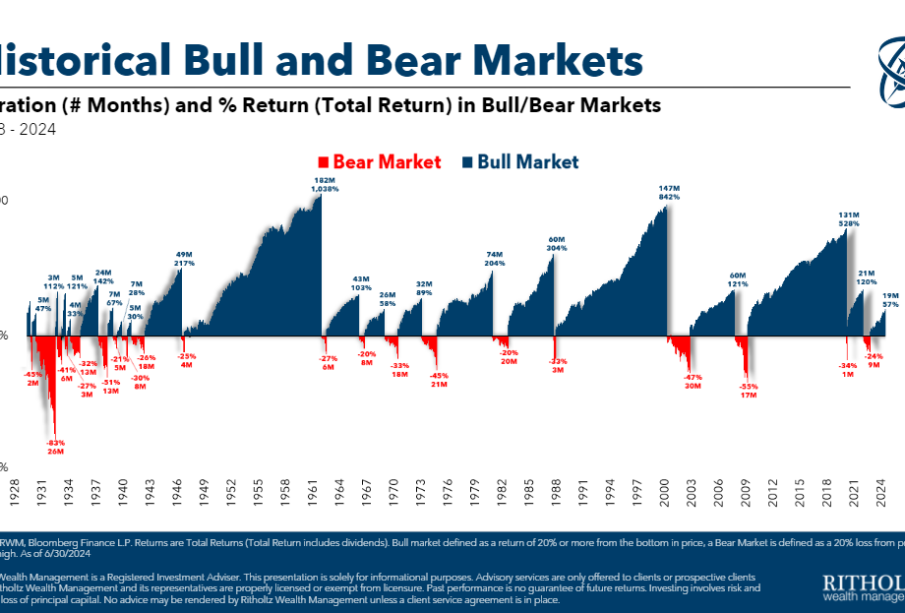

In the world of finance, understanding market dynamics is crucial for investors and policymakers alike. A bear market, defined as a period when securities prices fall by 20% or more from their recent highs, has significant implications for the economy and investor sentiment. As of late 2023, the equity markets have entered a bear phase, raising concerns about the potential duration and impact on the broader economy.

The Current State of the Market

As reported by various financial analysts, the global stock market has experienced increased volatility due to a confluence of factors, including rising interest rates, inflationary pressures, and geopolitical tensions. The S&P 500 index, which tracks the performance of 500 of the largest companies listed on stock exchanges in the United States, recently dipped into bear territory for the first time in over a year.

Key Factors Contributing to the Bear Market

Several key factors have contributed to the recent bear market:

- Inflation: Persistently high inflation has prompted central banks worldwide to raise interest rates, aiming to cool consumer spending. As borrowing costs increase, companies may face squeezed profit margins, leading to declining stock prices.

- Geopolitical Tensions: Ongoing conflicts and political instability, particularly in energy-rich regions, have created uncertainty about global supply chains and commodity pricing.

- Investor Sentiment: As market conditions deteriorate, investor confidence wanes. Fear of further losses often leads to panic selling, exacerbating the market decline.

Impact on Investors and the Economy

For investors, a bear market can induce fear and uncertainty. Many may look to liquidate their holdings to minimise losses, leading to potential long-term harm to retirement savings and overall portfolio value. Historically, bear markets have often been followed by recoveries; however, the timing and scale of these rebounds can vary significantly.

From an economic perspective, bear markets can signal a retreat in consumer confidence and spending. Businesses may also reconsider expansion plans, leading to potential layoffs and reduced hiring trends, thereby compounding economic challenges.

Conclusion

In conclusion, while a bear market poses challenges for both investors and the broader economy, it is essential to navigate it with a strategic mindset. Historically, markets have shown resilience, often recovering from downturns. Investors are advised to remain informed and consider long-term objectives rather than reacting to immediate market fluctuations. As we move deeper into 2023, vigilance in monitoring economic indicators will be crucial for understanding the potential recovery trajectory from this bear market.