Understanding the State Pension Age Increase in the UK

Introduction

The state pension age increase has become a significant topic in the United Kingdom, affecting millions of citizens and their retirement planning. As life expectancy rises and the financial sustainability of the pension system comes under pressure, increasing the state pension age aims to ensure that future generations can receive adequate support. This change is both a response to changing demographic factors and a necessary adjustment for economic stability.

Details of the Increase

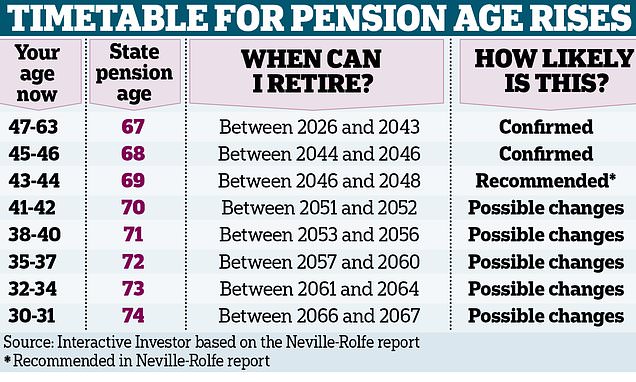

Currently, the state pension age is set to rise to 67 for both men and women by 2028 and could be increased further in the future. The latest projections by the UK Government suggest that the pension age may eventually reach 68 by 2039, impacting an estimated seven million people who will need to adjust their retirement plans accordingly. Such alterations in policy come after recommendations from the Government Actuary’s Department, which assesses the financial implications of state pensions as life expectancy continues to grow.

Public Reaction and Concerns

The increase in the state pension age is contentious and has elicited mixed reactions from the public. Many individuals have expressed concerns regarding the fairness of pushing back retirement age, especially for those in physically demanding jobs or those who have been unable to save adequately for retirement. Campaign groups argue that such policies disproportionately affect lower-income workers and those with poor health outcomes, who may not be able to work longer.

Future Implications

The repercussions of this state pension age increase extend beyond individual citizens’ retirement plans. It raises questions about the adequacy of the current pension system and the readiness of the workforce to meet these changes. Furthermore, this move could lead to increased pressure on the welfare system and local services which may need to support individuals who are unable to work or find alternative employment as they wait for their pension benefits to become available.

Conclusion

The increase in the state pension age remains a pressing issue that will shape the financial futures of many individuals. As the government continues to make adjustments to cater to an ageing population, it is imperative that stakeholders consider the broader social implications of such policy changes. For readers, staying informed about these developments is crucial, especially as they prepare for their own retirement. Future discussions should include ways to support those who may bear the brunt of these changes and ensure a dignified retirement for all.