Understanding the Recent Fluctuations in Tesla Share Price

Introduction

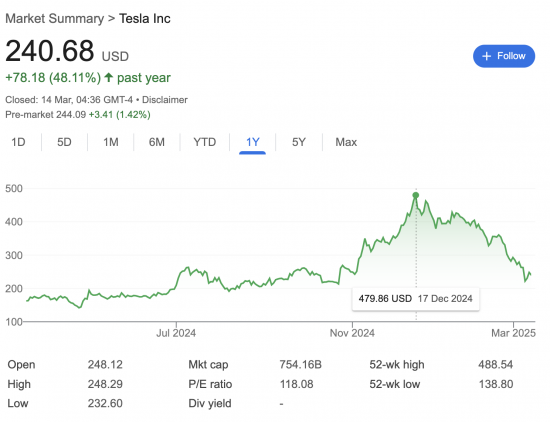

The share price of Tesla Inc. is a topic that garners significant attention from investors, analysts, and enthusiasts alike. As one of the leading electric vehicle manufacturers globally, Tesla’s (NASDAQ: TSLA) stock performance can greatly influence both the automotive and renewable energy markets. Given the recent fluctuations associated with Tesla share price, it is vital to investigate the underlying factors affecting these changes and what they could signal for the future.

Recent Trends and Market conditions

As of October 2023, Tesla’s share price has seen considerable volatility. Earlier in the month, the stock reached a peak of around £225 per share, influenced by a series of positive earnings reports and robust sales forecasts, particularly in key markets like China and Europe. However, the recent release of quarterly results fell short of market expectations, which led to a swift decline, dropping to approximately £185. This sudden decrease has prompted analysts to reassess their projections for the company’s short-term performance.

Key Factors Influencing Share Price

A variety of factors have contributed to the fluctuations in Tesla’s share price:

- Production Capacity: With increasing demand for electric vehicles, Tesla has ramped up production in its factories, effectively increasing its delivery capacity.

- Market Competition: The rise of competitive electric vehicle manufacturers has added pressure on Tesla to maintain its market share, prompting concerns about pricing strategies.

- Global Economic Conditions: Macro-economic factors such as inflation rates, supply chain disruptions, and geopolitical tensions have impacted investor sentiment regarding the entire tech and automotive sector.

Future Predictions

Looking forward, many analysts are cautiously optimistic about Tesla’s recovery. Investment banks like Goldman Sachs and Morgan Stanley predict that the stock could rebound towards £240 per share by the end of the year, driven by anticipated technological advancements and expanded market reach. However, investors are advised to remain vigilant of external factors that might sway the market.

Conclusion

In conclusion, the Tesla share price remains a complex indicator of not only the company’s performance but also broader market trends. As Tesla navigates its growth amidst fierce competition and economic uncertainties, understanding these dynamics is crucial for potential investors. The next few months will be vital for Tesla as it consolidates its position in the electric vehicle market, and market participants will be watching closely for any signs of sustained recovery.