Understanding the Nikkei 225: Trends and Implications

Introduction to the Nikkei 225

The Nikkei 225, a stock market index for the Tokyo Stock Exchange, serves as a vital gauge of Japan’s economic performance. As one of the oldest indices in the world, established in 1950, the Nikkei is closely watched by investors and analysts alike for insights into market movements and economic health in Japan. Given its significance, recent fluctuations within the index reflect broader trends in both the Japanese economy and global markets.

Recent Trends in the Nikkei 225

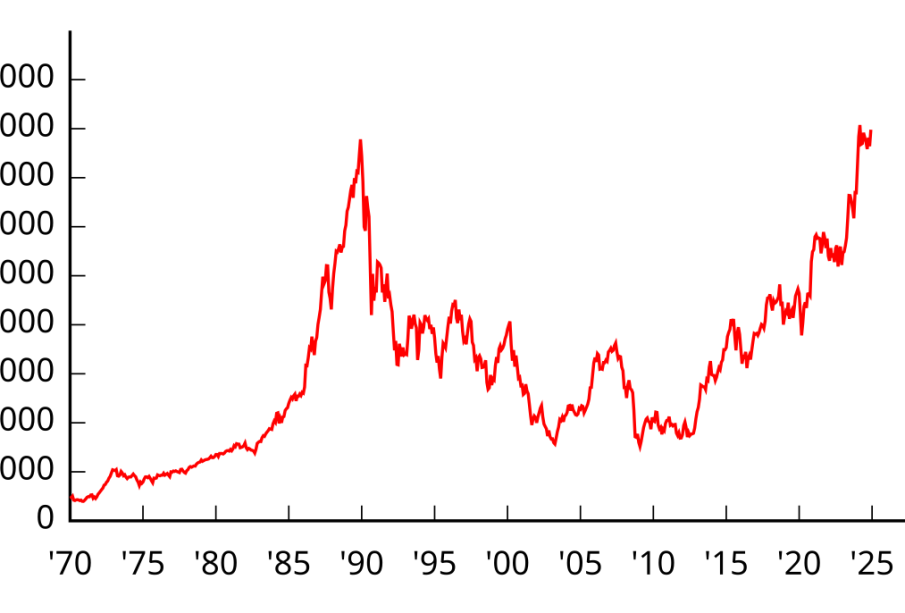

As of October 2023, the Nikkei 225 has shown marked resilience amid global economic uncertainties. Following a period of volatility due to changes in international monetary policies and geopolitical tensions, the index witnessed a notable surge, reaching levels not seen since the late 1980s. Key contributors to this rise include a strong resurgence in exports, bolstered by Japan’s core industries, and comprehensive government incentives aimed at stimulating growth.

Furthermore, the Bank of Japan (BoJ) has indicated a potential shift in its ultra-loose monetary policy, which has traditionally supported the stock market. Speculation around interest rate adjustments has led to increased optimism among investors, causing the Nikkei 225 to gain traction. As evidenced by recent trading days, the index has gained approximately 15% since the beginning of the year, reflecting growing confidence in corporate profitability and economic recovery.

Significance for Investors

The performance of the Nikkei 225 is not only a reflection of Japan’s economic landscape but also serves as an important benchmark for investors looking to engage with Asian markets. With Japan being the third-largest economy worldwide, movements in the Nikkei can impact global investment strategies, particularly in sectors such as technology and automotive, where Japan holds significant market share.

Investors should also remain vigilant regarding external factors influencing the index. Changes in U.S. monetary policy, shifts in trade relations, and global economic recovery trends will all play a crucial role in determining the future trajectory of the Nikkei 225. As experts forecast, a continued upward trend may indicate sustained growth in Japan, while potential setbacks could lead to heightened market volatility.

Conclusion

The Nikkei 225 remains a pivotal indicator of not just Japan’s economic health but also serves as a barometer for broader market trends. As global economic conditions evolve, the index will likely remain a focal point for investors. In light of the recent performance, understanding the driving forces behind the Nikkei 225 will be essential for those looking to capitalise on opportunities within the Japanese market. As we move forward, adaptability and awareness of both domestic and international factors will be central to strategic investment decisions.