Understanding the Nikkei 225 Index and Its Impact

Introduction

The Nikkei 225, Japan’s foremost stock market index, is a key barometer of the country’s economic health. Tracking the performance of 225 significant blue-chip companies listed on the Tokyo Stock Exchange, the Nikkei 225 offers investors insights into market trends and economic conditions. As investors globally adjust their strategies in response to fluctuating markets, understanding the movements of the Nikkei 225 becomes increasingly critical.

Recent Trends

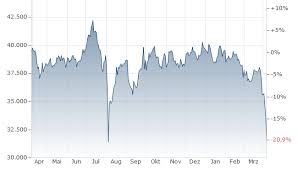

As of late October 2023, the Nikkei 225 has shown notable resilience amidst global economic uncertainties, including fluctuating inflation rates and geopolitical tensions. Recent reports indicate that the index has increased by approximately 10% since the beginning of the year, buoyed by factors such as increased domestic consumption and substantial foreign investments. This growth comes as Japan aims to recover from the effects of the pandemic, with government initiatives aimed at boosting economic activity playing a significant role.

Foreign Investment Influence

Increased foreign direct investment (FDI) into Japan has been a pivotal factor driving the Nikkei 225’s growth. International investment firms have been pouring money into Japanese companies due to their strong fundamentals and growth potential, especially in technology and renewable energy sectors. Analysts suggest that this influx could signal a shift in investor sentiment, viewing Japan not just as a safe haven but as a land of opportunities.

Corporate Performance

Major companies contributing to the index’s rise include Toyota Motor Corp and Sony Corporation, both of which have reported strong quarterly earnings buoyed by robust demand domestically and abroad. The ongoing global shift towards electric vehicles and advancements in entertainment technology are expected to continue benefiting these companies, thereby supporting the Nikkei 225.

Conclusion

Looking ahead, analysts remain cautiously optimistic about the future of the Nikkei 225. While there are concerns about potential market corrections amid rising interest rates and inflationary pressures, the overall sentiment leans towards a sustainable growth trajectory for Japan’s economy. For investors, keeping an eye on the Nikkei 225 could prove beneficial, as it reflects broader economic trends and potential investment opportunities in one of Asia’s largest economies.