Understanding the Lifetime ISA: A Comprehensive Guide

Introduction

The Lifetime ISA (LISA) has emerged as a crucial financial product for young adults in the UK, especially for those looking to buy their first home or save for retirement. Launched in 2017, the LISA aims to encourage long-term saving by offering attractive government bonuses. As the cost of living rises and housing challenges intensify, understanding the implications of the Lifetime ISA becomes increasingly important for both savers and potential homebuyers.

What is a Lifetime ISA?

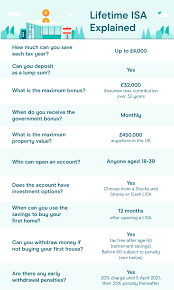

A Lifetime ISA is a type of individual savings account designed for those aged between 18 and 39, allowing them to save up to £4,000 each tax year. The government provides a 25% bonus on contributions, meaning savers can receive up to £1,000 per year. The LISA can be used to purchase a first home costing up to £450,000 or to supplement retirement savings after the age of 60.

Key Features of the Lifetime ISA

- Contribution Limits: The maximum contribution limit is £4,000 per year. However, this amount counts towards the overall annual ISA limit of £20,000.

- Government Bonus: The 25% government bonus is an attractive feature, rewarding savers for their commitment. This bonus is added at the end of the financial year.

- Withdrawals: Savers can withdraw funds to buy their first home or at age 60 for retirement purposes. Early withdrawals for other reasons incur a penalty of 25% on the amount withdrawn.

Current Trends and Events

The lifetime ISA’s relevance has surged amidst rising property prices and affordability challenges faced by first-time buyers. Recent studies show that a significant number of first-time buyers are unaware of the LISA or its potential benefits. In response, financial organisations and advisers are increasing efforts to educate the public about available savings options.

Moreover, with changes to the Help to Buy scheme and other government incentives, the Lifetime ISA remains a vital alternative. Many financial experts recommend incorporating the LISA into an overall savings strategy for those planning to enter the property market.

Conclusion

The Lifetime ISA offers an invaluable opportunity for young savers aiming to attain home ownership or bolster their retirement fund. Its government-backed incentives make it an appealing choice in today’s financial landscape. As more people strive for financial stability amidst economic challenges, the Lifetime ISA stands as a beacon of support, promoting responsible savings and investment. It will be essential for potential investors to stay informed and seek guidance on maximising the benefits of this scheme while adapting to the ever-evolving financial environment.