Understanding the Impact of Council Tax Hikes in the UK

Introduction

Council tax hikes have become a pressing topic across the United Kingdom, as many local authorities grapple with budget constraints and rising costs. With inflation reaching new heights, local councils are raising their tax rates to maintain essential services and infrastructure. This article explores the causes behind these increases, how they affect residents, and what implications they hold for the future.

The Factors Behind Council Tax Hikes

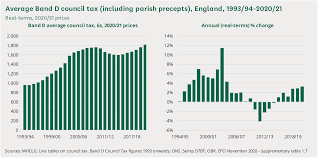

In recent months, numerous councils in England and Wales have announced plans to increase council tax rates. According to the House of Commons, the average council tax in England has risen by over 4% in 2023, with some councils seeing hikes as high as 5%. These hikes are typically justified by rising costs in social care, education, and housing sectors, which constitute significant portions of council budgets.

Local Council Budget Struggles

Local councils have been facing unprecedented financial challenges, compounded by the COVID-19 pandemic, inflation, and reduced central government funding. With a 40% decrease in central government grants over the last decade, many councils are left with limited options but to pass on the costs to residents through increased taxes. In particular, the Local Government Association has warned that unless councils are provided with additional funding, they will continue to be forced to raise council tax rates to cover basic services.

Impact on Residents

The increasing council tax burden hits some demographic groups harder than others. Households with fixed or lower incomes, such as pensioners or single-parent families, find it increasingly difficult to manage their finances. Critics argue that while the hikes may be necessary, they disproportionately affect the most vulnerable members of society. In contrast, there are voices suggesting that the affluent should contribute more, possibly through a revaluation of council tax bands.

Future Outlook

As councils prepare for the upcoming financial year, the trend of council tax hikes is unlikely to abate. Many local authorities warn that further increases could be on the horizon, particularly if inflation persists. It is essential for residents to stay informed about proposed changes to council tax rates in their local areas and actively participate in consultations when available.

Conclusion

Council tax hikes present a complex issue with significant implications for residents throughout the UK. As local councils continue to navigate challenging financial landscapes, the need for sustainable funding sources and equitable taxation remains critical. For residents, understanding the dynamics of these increases will aid in budgeting and advocacy efforts on local government matters, ensuring that essential services are adequately funded without disproportionately burdening those already struggling.