Understanding the ASX 200: Performance and Trends

Introduction to the ASX 200

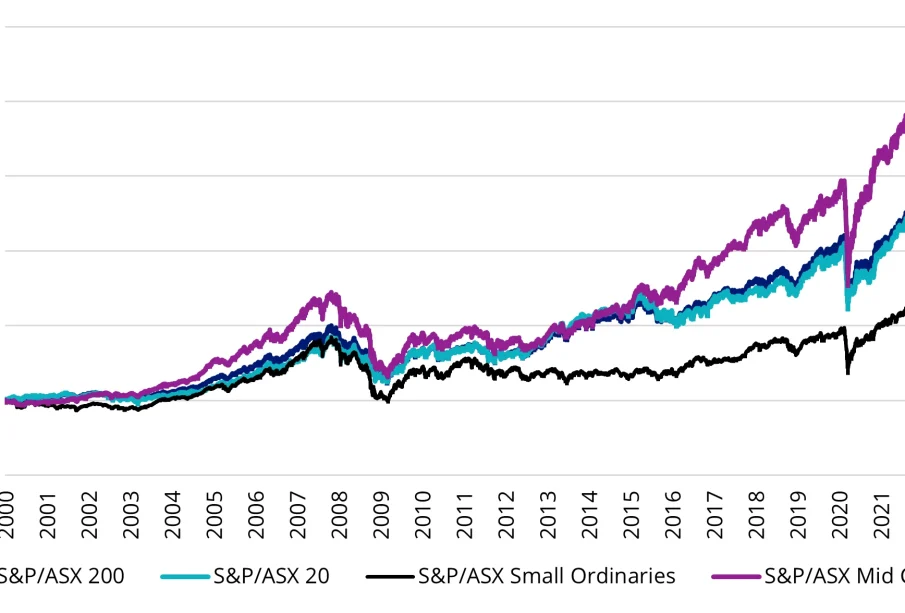

The ASX 200 is a stock market index that measures the performance of the 200 largest listed companies on the Australian Securities Exchange (ASX). It is widely regarded as a benchmark for the Australian equity market. As Australia’s economy continues to recover post-pandemic, understanding the trends and movements within the ASX 200 is crucial for investors and market analysts alike.

Recent Trends in the ASX 200

As of October 2023, the ASX 200 has witnessed noticeable fluctuations influenced by various factors including inflation rates, commodity prices, and global economic conditions. The index has been performing relatively well, registering a year-to-date increase of approximately 10%, buoyed primarily by strong performances in sectors such as resources and financial services.

Key drivers include:

- Commodity Surge: The rising prices of commodities like iron ore and lithium, driven by robust demand from China, have significantly benefitted mining companies, leading to an uptick in their stock prices.

- Interest Rates: The Reserve Bank of Australia has recently maintained low interest rates to stimulate growth, positively impacting investor sentiment.

- Global Economic Recovery: As economies around the world rebound from the COVID-19 pandemic, investor confidence has improved, reflecting in the ASX 200’s performance.

Impacts on Investors

For investors, the ASX 200 serves as a useful tool for gauging market sentiment and making informed investment decisions. Many analysts recommend reviewing sectors that are showing growth potential. For instance, technology and healthcare equities, which have traditionally underperformed, are now being assessed for their long-term viability amidst changing market dynamics.

Additionally, Exchange Traded Funds (ETFs) that track the ASX 200 are gaining popularity among retail investors, providing a diversified portfolio option without the need for extensive individual stock research.

Conclusion and Future Outlook

Moving forward, analysts predict that the ASX 200 may continue its upward trajectory, albeit with potential volatility depending on global economic developments, interest rates, and local economic conditions in Australia. For investors, staying informed and understanding the underlying factors affecting the ASX 200 will be pivotal in navigating the stock market landscape.

In conclusion, the ASX 200 not only reflects the performance of leading Australian companies but is also a vital indicator of the broader economic health. As we move into the last quarter of 2023, investors should remain vigilant to capitalize on opportunities arising from this ever-evolving market.