Understanding NS&I: National Savings and Investments Explained

Introduction to NS&I

National Savings and Investments (NS&I) is a notable entity in the UK’s financial landscape. As a government-backed institution, NS&I provides secure savings options for UK residents and offers a safe haven for their investments amidst fluctuating market conditions. With recent changes in interest rates and economic uncertainty, understanding NS&I has become increasingly relevant.

Overview of NS&I Products

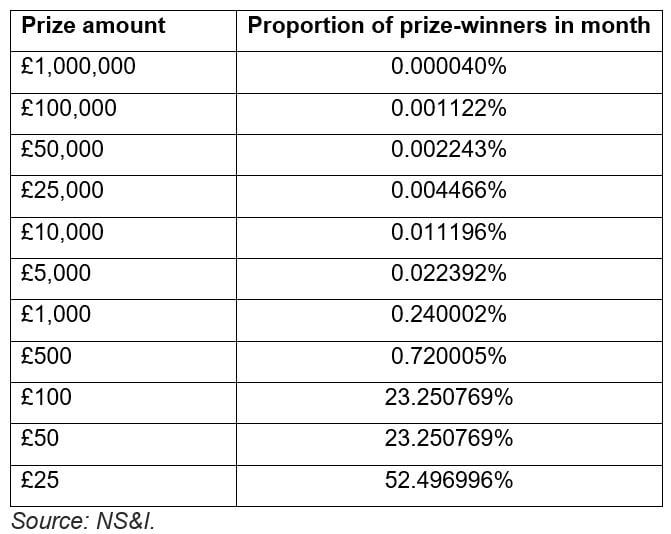

NS&I offers a variety of savings products, including Premium Bonds, Income Bonds, and Fixed Rate Bonds, all designed to cater to different financial goals. Premium Bonds, one of their flagship products, give savers the chance to win tax-free prizes instead of earning interest. As of October 2023, the odds of winning with Premium Bonds has improved significantly, making them even more appealing to the public.

Additionally, NS&I has announced new interest rates for their income bonds and fixed rate bonds as a response to rising inflation. The maximum rate for Income Bonds now stands at 1.75%, while the fixed rate products yield between 2.2% and 3.2%, depending on the term. These adjustments have made NS&I’s offerings competitive in the current savings market.

Importance of NS&I in the UK Economy

NS&I plays a crucial role in the UK economy by promoting savings and providing a safe investment option for individuals who may feel uncertain about traditional investments in stock markets or property. During economic fluctuations, the secure nature of NS&I attracts savers who prioritise the safety of their capital above potential higher returns.

Moreover, the funds raised through NS&I contribute to government financing, playing a vital role in supporting public spending and investments in essential services. As the government continues to navigate economic challenges, NS&I remains a key player in facilitating national savings and investments.

Future Prospects and Conclusion

Looking ahead, NS&I is expected to adapt its offerings further in response to market changes and consumer needs. As inflation rates and economic uncertainty persist, savers are becoming increasingly cautious, which could lead to a greater interest in the products offered by NS&I.

In conclusion, the relevance of NS&I in today’s economic climate cannot be overstated. Its commitment to providing safe, government-backed savings options ensures that it will remain a vital component of the UK’s financial fabric. For savers seeking security in uncertain times, NS&I will continue to be a trusted option worth considering.