Understanding HMRC Self Assessment: A Complete Guide

Introduction to HMRC Self Assessment

HMRC self assessment is a critical process for individuals and businesses in the UK to report their income and expenses for tax purposes. Understanding this system is essential, as it enables taxpayers to meet their responsibilities while avoiding unnecessary penalties. With the financial landscape ever-changing, particularly in the current climate of economic recovery and digital advancements, staying informed about self assessment is more important than ever.

What is HMRC Self Assessment?

Self assessment is a method used by HM Revenue and Customs (HMRC) to collect income tax. Taxpayers must submit a self assessment tax return if they earn money that is not taxed at source, for example, self-employed income, rental income, or overseas income. The deadline for submitting the tax return and paying any tax owed is usually January 31st following the end of the tax year on April 5th.

Who Needs to Complete a Self Assessment?

Not everyone is required to file a self assessment tax return. Groups that typically need to include:

- Self-employed individuals earning more than £1,000

- Landlords receiving rental income

- Individuals with overseas income

- Directors of companies unless they are paid through PAYE

- High earners with an income over £100,000

It is crucial that taxpayers check whether they need to register for self assessment, as failing to do so can lead to penalties.

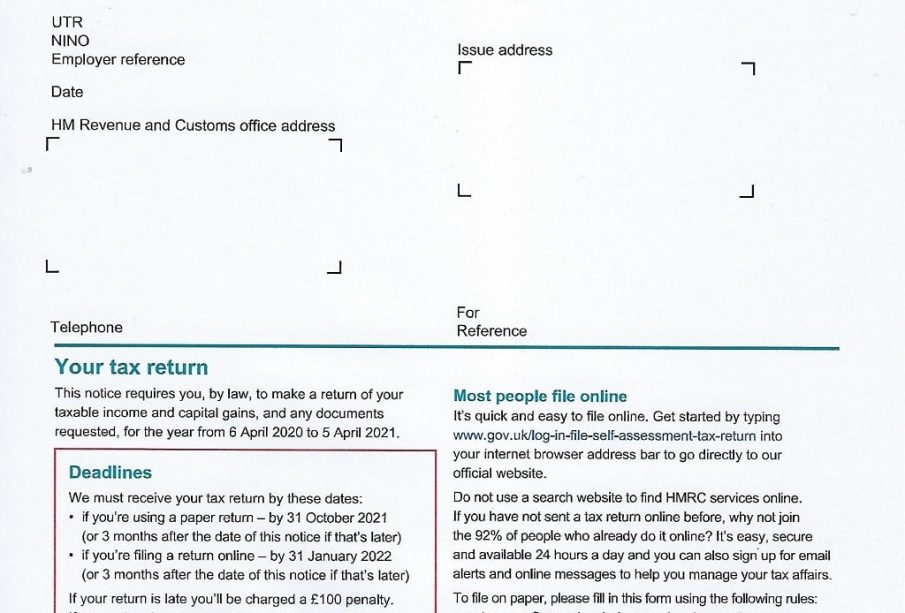

The Process of Filing a Self Assessment

To file a self assessment, individuals must first register with HMRC. Once registered, they will receive a Unique Taxpayer Reference (UTR) that they will use to file their return online or via paper forms. The online system makes the process straightforward and allows for easier recordkeeping.

Key Deadlines

The main deadlines to keep in mind are:

- Register for self assessment: October 5th (following the end of the tax year)

- Submit your tax return: January 31st

- Pay any tax owed: January 31st

Missing these deadlines can result in automatic penalties, making punctuality essential.

Conclusion and Importance of Compliance

HMRC self assessment is a crucial aspect of the UK tax system that allows taxpayers much-needed flexibility in reporting their earnings. Compliance ensures that individuals and businesses contribute their fair share to public finances while avoiding penalties. As financial regulations evolve, it is expected that the self assessment process will continue to be modernised and streamlined. It is important for anyone who is liable to self assessment to keep good records and stay informed about changes to the tax system, as this will help ensure they meet their obligations efficiently. Therefore, staying educated and compliant not only benefits taxpayers personally but also supports the greater economic framework of the United Kingdom.