Understanding FTSE 100 Share Price Trends

Introduction

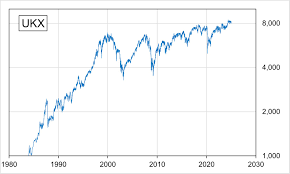

The FTSE 100, representing the largest companies listed on the London Stock Exchange, is a crucial indicator of the UK’s economic health. Investors closely monitor its share price to gauge market performance. As global economic conditions evolve, understanding the factors affecting the FTSE 100 share price remains vital for both seasoned and new investors.

Current Trends and Analysis

As of mid-October 2023, the FTSE 100 index has experienced some fluctuations, primarily driven by economic data releases, corporate earnings reports, and geopolitical events. Recently, the index was observed around the 7,400 mark, with a year-to-date gain of approximately 5%. Analysts attribute this performance to several factors, including resilience in the UK economy, a rebound in consumer confidence, and an overall positive outlook for major sectors like technology and energy.

Economic Indicators

Key economic indicators, such as inflation rates and interest rates set by the Bank of England, have a significant impact on the FTSE 100 share price. The latest data shows inflation has been decreasing, which may lead to a more stable monetary policy. On the other hand, any unexpected changes in interest rates could impact investor sentiment and, consequently, the share price.

Corporate Earnings

Corporate earnings reports from major constituents of the FTSE 100 also play a pivotal role. In the recent earnings season, large companies like Unilever and BP have reported better-than-expected results, reinforcing positive investor sentiment. These results are crucial as they often set the tone for trading across the index, particularly if they suggest a strong economic recovery.

Geopolitical Factors

Moreover, ongoing geopolitical issues, including tensions in Eastern Europe and trade dynamics with major economies, can introduce volatility into the FTSE 100 share price as investors react to potential risks. Recent developments have shown a mixed impact, leading to cautious trading as investors digest implications for global trade and economic stability.

Conclusion

In conclusion, the FTSE 100 share price serves as a barometer for the UK economy, reflecting investor confidence and market dynamics. For potential and existing investors, closely monitoring economic indicators, corporate earnings reports, and geopolitical events will be essential in making informed decisions. With analysts predicting potential growth, the outlook for the FTSE 100 remains cautiously optimistic. Staying updated on trends will be vital for navigating this ever-evolving financial landscape.