Understanding Current Interest Rates for Mortgages

The Importance of Mortgage Interest Rates

Mortgage interest rates are a critical component of the housing market, directly influencing home affordability and purchasing decisions. As the Bank of England adjusts its base rate in response to economic conditions, homeowners and potential buyers must stay informed to navigate the market effectively.

Current Trends in Interest Rates

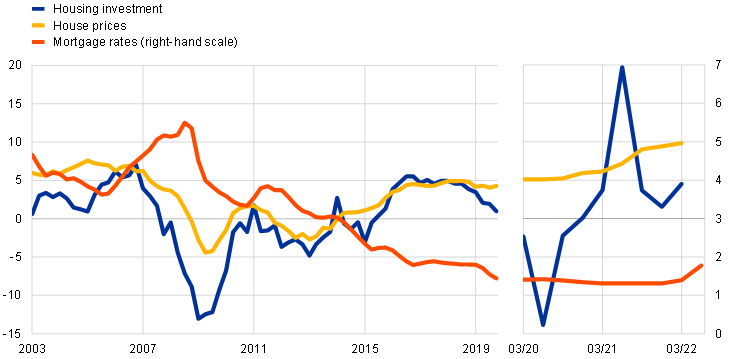

As of October 2023, the Bank of England’s base rate stands at 5.25%. This increase over the last two years reflects efforts to combat rising inflation, which currently sits at 6.7%. Consequently, mortgage lenders have adjusted their offerings, resulting in higher interest rates for both fixed and variable-rate mortgages. Fixed mortgage rates, previously averaging around 2-3%, have surged to 5-6%, significantly impacting monthly repayments for new buyers and those looking to remortgage.

Impact on Homebuyers

The rise in interest rates has led to increased caution among prospective homebuyers. According to recent data from the UK Finance, mortgage approvals have dropped by 15% compared to last year. Higher monthly payments mean that buyers are reconsidering their budgets, with some opting for smaller homes or delaying purchases altogether. Additionally, the average age of first-time buyers has risen to 35, as individuals take longer to save for larger deposits and navigate the complexities of borrowing in today’s economic climate.

Future Outlook

Experts predict that interest rates may stabilise in early 2024, provided inflation decreases as hoped. Market analysts suggest that potential reductions in the base rate could occur if consumer expenditure and price growth show signs of improvement. However, significant uncertainty remains, and potential buyers should remain vigilant.

Conclusion

For anyone looking to purchase a home or refinance their existing mortgage, understanding interest rates is paramount. With rates being higher than they have been in recent years, consumers must weigh their options carefully. Seeking advice from mortgage advisers and staying updated on economic trends can help individuals make informed decisions in this fluctuating market. The importance of monitoring interest rates cannot be overstated, as they have long-lasting implications for homeownership in the UK.