Understanding BTC USD: Current Trends and Insights

Introduction

The BTC USD exchange rate has increasingly captured the attention of investors, traders, and financial analysts around the globe. Understanding the fluctuations in this exchange rate is crucial, not only for cryptocurrency enthusiasts but also for individuals and businesses looking to capitalise on potential investment opportunities. As Bitcoin continues to be a significant player in the global financial landscape, gaining insights into its price movement against the USD provides valuable knowledge for both short-term trading and long-term investment strategies.

Current State of BTC USD

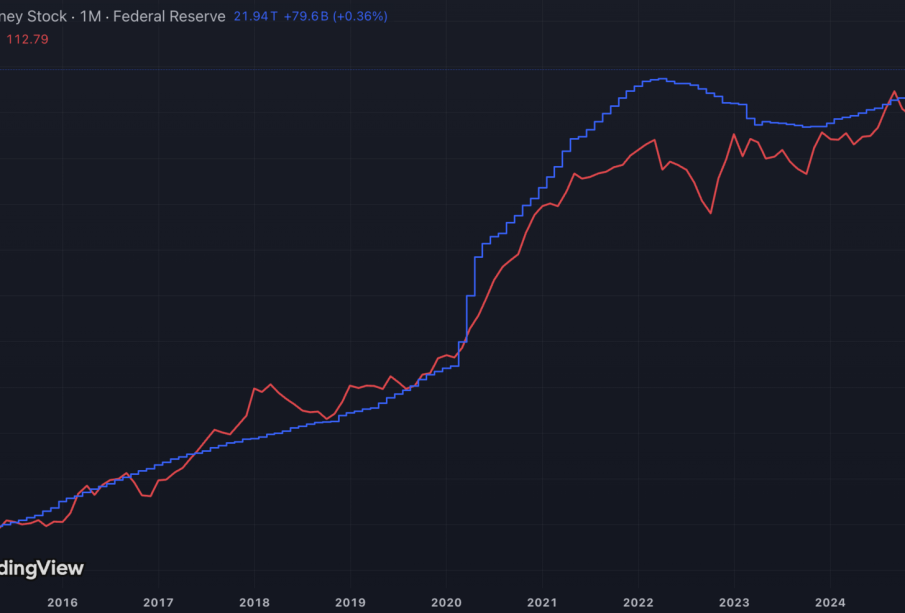

As of October 2023, Bitcoin’s price has seen substantial volatility, with recent reports indicating a trading range between $25,000 and $35,000 USD. The dynamic nature of BTC USD is influenced by multiple factors including market sentiment, regulatory developments, Bitcoin mining fundamentals, and macroeconomic indicators such as inflation and interest rates.

In recent weeks, Bitcoin’s price gained momentum as institutional investors showed renewed interest, alongside a wave of new retail investors entering the market. A recent survey indicated that more than 20% of surveyed businesses are considering accepting Bitcoin as a payment method, further validating its role as a potential currency for everyday transactions.

Market Influences and Events

Several key events have contributed to the current trends in BTC USD. Legislative discussions around cryptocurrency regulations in the United States and Europe have sparked debates regarding the future landscape of digital assets. Positive regulatory news can lead to increased investor confidence, while stricter regulations can trigger sell-offs.

Furthermore, technological advancements for Bitcoin, such as the improvement of transaction speeds through the Lightning Network, also play a role in bolstering its value. As Bitcoin continues to evolve, these technological factors alongside market sentiments are likely to heavily influence its price performance against the USD.

Conclusion

As BTC USD continues to fluctuate, both seasoned investors and novices must stay informed regarding market trends and global economic conditions. While the potential for profit exists, it is essential to approach investments with caution due to the inherent risks associated with cryptocurrencies. Looking forward, experts predict continued volatility, with Bitcoin’s price remaining susceptible to both external economic pressures and internal developments within the crypto ecosystem. Understanding these dynamics will be key for anyone looking to navigate the evolving landscape of Bitcoin and its valuation against the dollar.