The Benefits of Tax Cash ISAs: A Comprehensive Guide

Introduction

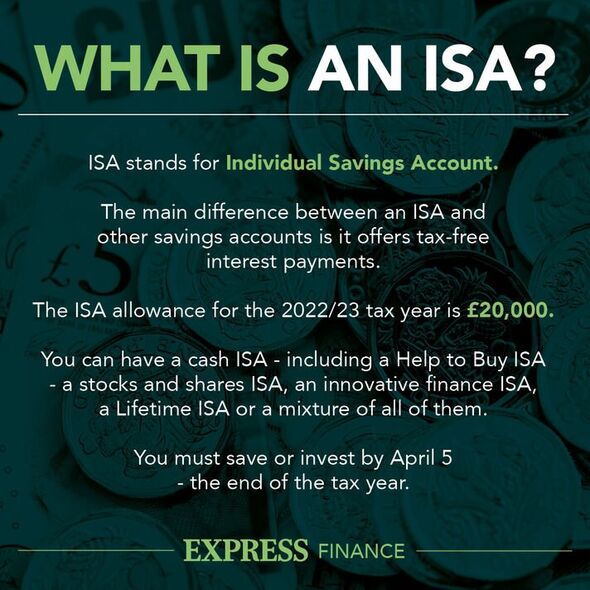

Tax Cash ISAs (Individual Savings Accounts) have gained significant attention in the UK as a tax-efficient way to save money. With rising living costs and economic uncertainty, many individuals are looking for reliable savings options that can offer both security and tax advantages. Understanding Tax Cash ISAs is essential for UK residents aiming to maximise their savings while minimising their tax liabilities.

What is a Tax Cash ISA?

A Tax Cash ISA is a type of Individual Savings Account that allows UK residents to save money without paying tax on the interest earned. Established under the UK government’s ISA scheme, these accounts have a set annual limit for contributions. For the tax year 2023/24, the total ISA allowance is £20,000, which can be split across different types of ISAs.

Key Benefits of Tax Cash ISAs

The primary advantage of a Tax Cash ISA is the tax-free interest it offers, meaning all gains on savings are free from Income Tax and Capital Gains Tax. This feature makes them an attractive option for both short-term and long-term savings goals. Moreover, funds in a Tax Cash ISA can be accessed at any time, giving savers flexibility in managing their finances.

Current Trends and Utilisation

As of October 2023, the popularity of Tax Cash ISAs continues to rise, particularly among younger savers. According to recent reports, around 28% of UK adults hold some form of ISA. With banks and financial institutions increasingly offering competitive interest rates on Tax Cash ISAs, it is crucial for savers to shop around to ensure they receive the best deals available.

Conclusion and Future Implications

In conclusion, Tax Cash ISAs represent a powerful tool for effective tax-free saving. As the financial landscape continues to evolve, it is expected that more individuals will turn to these accounts to secure their financial futures. Given current economic challenges, including inflation and fluctuating interest rates, Tax Cash ISAs offer not only a safe haven for funds but also a strategic approach to wealth accumulation without the burden of taxation. Savers should carefully consider their options and remain informed on changes to ISA regulations to fully capitalise on the benefits of Tax Cash ISAs.