Insights into Barclays Share Price Trends

Introduction

The Barclays share price is a significant indicator of the bank’s health and performance in the London Stock Exchange. As a major player in the financial sector, understanding the fluctuations in its share price provides insights into both the company’s operational effectiveness and the broader economic landscape. Investors, analysts, and stakeholders closely monitor these changes to make informed decisions about their financial engagements.

Current Performance and Influencing Factors

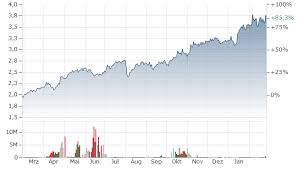

As of late October 2023, Barclays shares have shown modest volatility, trading around £1.90 per share. This performance comes amid broader market fluctuations, influenced by changing interest rates and economic concerns related to inflation and global supply chain issues. In the most recent quarterly report, Barclays reported a net income rise attributed to increased net interest margins and expanded customer lending, which bolstered investor confidence in its stock.

In the past few months, several factors have played a pivotal role in the movement of Barclays’ share price. Analysts indicate that the Bank of England’s decisions on interest rates significantly impacted investor sentiment, given that higher rates will directly affect the profitability of banks like Barclays. Furthermore, geopolitical tensions and market expectations surrounding the UK economy have added further complexity to the stock’s performance.

Market Sentiment and Investor Outlook

Despite some recent pressures, market sentiment around Barclays’ share price appears cautiously optimistic. Analysts project potential growth in the bank’s profitability due to its strong performance in the corporate banking sector and a diversified portfolio responding well to varying market conditions. Furthermore, Barclays has committed to reducing costs and enhancing operational efficiencies, steps that could positively affect its share price in the long run.

Investors are also reacting to forecasts that suggest a rebound in consumer spending, particularly as pandemic restrictions continue to ease. This trend, coupled with sustainable lending practices and digital banking initiatives, positions Barclays for potential positive growth in share price as it capitalises on changing consumer needs.

Conclusion

In conclusion, the Barclays share price remains an essential metric for understanding the bank’s operational success and resilience in a challenging economic environment. While current market conditions remain somewhat volatile, the outlook for Barclays remains cautiously optimistic due to effective management strategies and a projected recovery in consumer confidence. For investors and analysts, staying updated on these trends and market indicators is crucial for making informed decisions regarding their investments in Barclays and the financial sector as a whole.