Inside the World of Scott Bessent: A Look at His Investment Strategies

Introduction

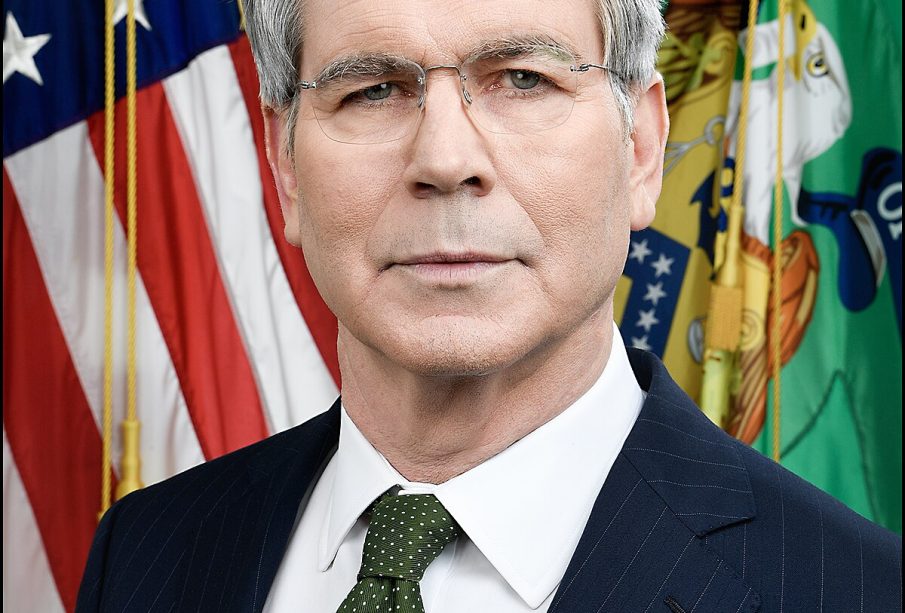

Scott Bessent, a prominent figure in the investment community, has made significant impacts through his strategies and insights into the market. His role as a leading investor and advisor has brought attention to new trends and investment techniques. Understanding Bessent’s approach is relevant today as individuals and institutions alike navigate an ever-changing financial landscape.

Early Career and Achievements

Bessent’s career began at the prestigious investment firm Morgan Stanley, where he honed his skills in macroeconomic analysis. He later served as the Chief Investment Officer for George Soros’s renowned family office, Soros Fund Management, from 2011 to 2015. During his time there, Bessent managed a multi-billion dollar portfolio and was instrumental in numerous high-profile investments, particularly in emerging markets.

Current Ventures

Currently, Scott Bessent operates his own investment management firm, Key Square Group, LLC, where he continues to leverage his extensive background in global markets. Under his direction, Key Square Group has focused on strategic investments in various sectors, including technology and sustainable energy. Bessent is well-respected for his ability to predict market shifts, which has led to his firm’s success amid uncertainty in global economies.

Investment Philosophy

Bessent’s investment philosophy stems from a deep understanding of macroeconomic factors and their impact on market dynamics. He emphasises rigorous analysis and diligent research, often diving into underappreciated sectors that show potential for growth. His approach combines traditional investment strategies with a forward-thinking mindset, aligning well with current trends in sustainability and social responsibility.

Recent Market Insights

In recent interviews, Bessent has highlighted the importance of adapting investment strategies in light of ongoing geopolitical tensions and economic recovery post-pandemic. He believes that technology-driven businesses stand to gain significantly as global markets recover, urging investors to pay attention to data-driven companies that prioritise innovation. Furthermore, his insights into the rise of alternative investments have encouraged many to consider diversifying their portfolios beyond traditional stocks and bonds.

Conclusion

Scott Bessent’s contributions to the field of investment offer both historical context and a roadmap for future strategy. As he continues to navigate the complexities of the global market, his predictions and observations are vital for both seasoned investors and newcomers. Bessent’s career exemplifies the potential for strategic foresight in investing, highlighting that in this unpredictable world, informed decisions driven by comprehensive research can lead to substantial success.