Finding the Best Mortgage Rates in the UK

Introduction

Securing a mortgage is one of the most significant financial decisions for individuals and families in the UK. With ever-changing market dynamics, understanding and finding the best mortgage rates is crucial for potential homebuyers. Lower mortgage rates can lead to substantial savings over the life of a loan, making it essential for borrowers to stay informed about current offerings and trends.

Current Mortgage Market Overview

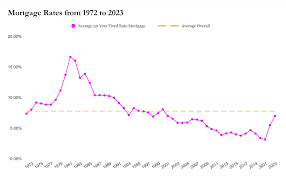

As of October 2023, the UK mortgage market is witnessing a gradual decline in interest rates following the peak levels observed in 2022. According to the Bank of England, the average two-year fixed mortgage rate has decreased to around 4.5%, while the five-year fixed rate now averages about 4.8%. Economic factors such as lower inflation rates and stabilisation in the housing market are contributing to this downward trend.

Comparing Mortgage Rates

When shopping for mortgage rates, it is critical for borrowers to compare products from various lenders. Traditional banks, building societies, and online mortgage providers have different criteria and offerings. For example, some lenders may provide competitive rates for borrowers with larger deposits, while others may offer incentives like cashback deals or free valuations. Online comparison tools have made it easier for buyers to assess their options and find the best deal tailored to their financial situation.

Significance of Credit Scores

One often-overlooked aspect influencing mortgage rates is the borrower’s credit score. Lenders often reserve their best rates for those with excellent credit histories. Prospective buyers should check their credit scores and consider taking steps to improve them ahead of applying for a mortgage, such as paying off debts or ensuring bills are paid on time. Maintaining a good credit score can lead to more favourable mortgage terms.

Conclusion

Understanding the current landscape of mortgage rates in the UK is essential for anyone looking to purchase a home. As the average rates continue to decrease, now may be an opportune time for borrowers to explore their options. By leveraging comparison tools and maintaining good credit, homebuyers can secure the best mortgage rates available, ultimately saving thousands over the life of their loans. It is advisable for potential borrowers to seek guidance from financial advisers to ensure they navigate this crucial process effectively.