Exploring the Wealth Tax: Implications and Relevance

Introduction to Wealth Tax

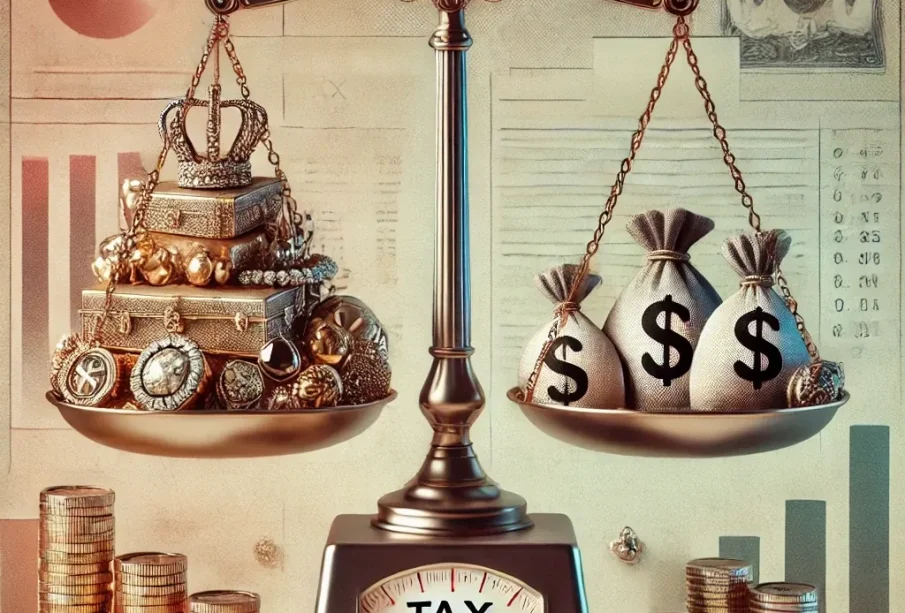

As economic inequality continues to rise, discussions surrounding wealth tax have gained significant traction across the globe. A wealth tax is a levy based on the market value of assets owned by an individual, targeting the wealthiest segments of society. This tax is viewed as a potential solution to address economic disparities, promote social equity, and generate revenue for public services. With various countries considering or implementing such taxes, understanding their implications has become increasingly relevant for voters and policymakers alike.

Global Context and Trends

Countries like Spain and France have historically implemented wealth taxes, with varying degrees of success and public support. Recently, proposals for wealth taxes have resurfaced in the United States, UK, and other nations, particularly amidst growing concerns about the wealth gap exacerbated by the COVID-19 pandemic. A report from Oxfam in January 2023 highlighted that the world’s billionaires saw their fortunes swell by $3.8 trillion during the pandemic, intensifying calls for a wealth tax as a fair method to redistribute resources and fund vital public services.

Recent Developments

In the UK, Labour Party leader Keir Starmer has publicly supported a review of wealth taxation as part of a broader strategy to tackle inequality. While specifics are yet to be outlined, the proposal seeks to address how wealth distribution has shifted in favour of the richest during recent crises. In parallel, some US lawmakers have proposed introducing a new wealth tax aimed at those with assets exceeding certain thresholds, hoping to generate funds for education and healthcare.

bjectives and Implications

The primary objectives of wealth tax proposals often include addressing income inequality, funding societal improvements, and ensuring that the wealthiest contribute a fair share to the economy. However, critics argue that wealth taxes can lead to capital flight, where the wealthy move assets or reside in countries with more favourable tax regimes. For instance, a study from the National Bureau of Economic Research in 2022 indicated that California’s wealth tax proposals could discourage high-income individuals from residing in the state, as they seek better tax climates.

Conclusion and Future Outlook

The conversation surrounding wealth tax is gaining momentum as governments grapple with the dual challenges of economic recovery and inequality. While wealth taxes may provide a pathway to significant revenue increases and social equity, careful consideration must be paid to potential consequences, including capital flight and changes in investment behaviour. As discussions evolve, the significance of wealth tax will likely remain a focal point in economic policy debates, with implications for voters across the political spectrum.