Exploring the Current State of Inflation in 2023

Introduction

Inflation has emerged as a critical topic in economic discussions globally, especially in 2023. As countries grapple with fluctuating prices and the cost of living rises, understanding inflation becomes ever more pertinent for consumers, policymakers, and businesses. This article aims to shed light on the current state of inflation, its causes, and its implications for everyday life.

Current Trends in Inflation

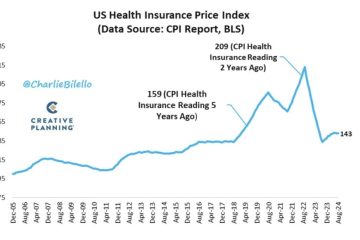

As of 2023, inflation rates have shown significant variation across different regions. In the United Kingdom, the Consumer Price Index (CPI) reported an inflation rate of approximately 6.7% in August, a decline from an earlier peak of over 10% in October 2022. Conversely, the United States also witnessed a decline in inflation rates, with figures hovering around 3.7%, down from a 40-year high of 9.1% in June 2022. These fluctuations signal a gradual recovery from the intense price surges seen during the pandemic.

Causes of Rising Inflation

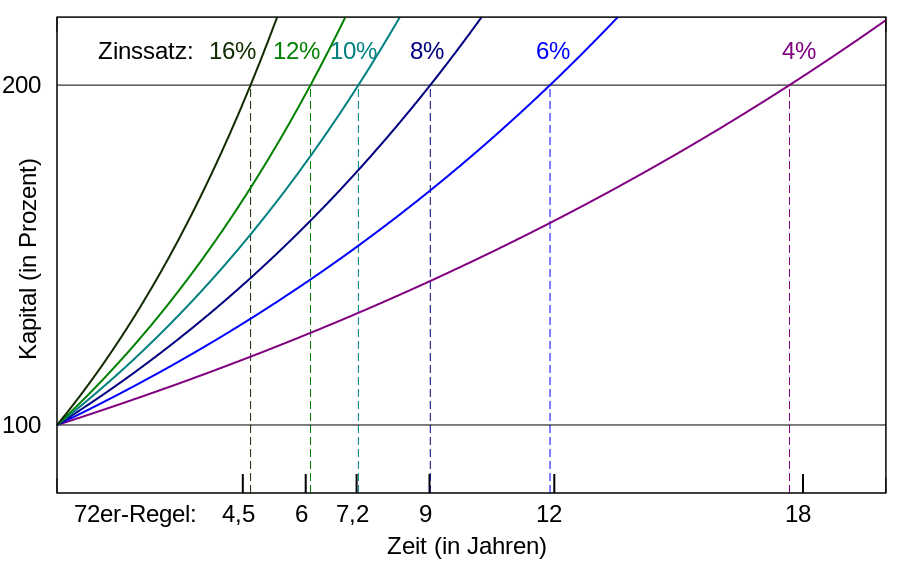

The primary drivers of inflation can be broken into two categories: demand-pull inflation and cost-push inflation. Demand-pull inflation occurs when demand for goods and services exceeds supply, often seen during economic recoveries. Meanwhile, cost-push inflation is driven by rising costs of production, which have been exacerbated by supply chain disruptions, energy price spikes due to geopolitical tensions, and labour shortages. Additionally, central banks have responded to inflationary pressures by adjusting interest rates, further influencing overall economic dynamics.

Implications for Consumers and Businesses

The consequences of ongoing inflation are felt most acutely by consumers, who are witnessing rising prices for essential goods, housing, and services. This squeeze on disposable income can lead to changes in consumer behaviour, prompting households to reassess spending priorities. For businesses, inflating costs of raw materials and wages may lead to reduced profit margins or higher prices for consumers, creating a potential feedback loop that sustains inflationary pressure.

Conclusion

Inflation remains a critical issue in the current economic landscape, requiring continuous monitoring and analysis. As we progress through 2023, the measures taken by central banks and governments to manage inflation will be pivotal in shaping economic stability and recovery. For consumers, understanding inflation is vital for making informed financial decisions, while businesses must adapt to the evolving market conditions to maintain competitiveness. The ongoing dialogue surrounding this economic phenomenon will determine its long-term implications for global markets and individual livelihoods.