Everything You Need to Know About HMRC Self Assessment

Introduction

The HMRC self assessment process is a crucial aspect of the UK tax system, enabling individuals and businesses to report their income and pay the correct amount of tax. As of the 2023 tax year, understanding this process has never been more relevant, given the rise in self-employed individuals and freelancers in the UK due to the changing nature of work. Being informed about self assessment can help prevent penalties and ensure compliance with tax obligations.

What is HMRC Self Assessment?

HMRC self assessment is a system that requires taxpayers in the UK to declare their income and gains to HM Revenue and Customs (HMRC). This includes income from employment, self-employment, pensions, and rental income, among other sources. Taxpayers must complete a tax return each year, detailing their earnings and any deductions or allowances they may claim.

Why is Self Assessment Important?

Self assessment is essential because it ensures that each individual pays the correct amount of tax based on their income. It also allows taxpayers to claim back any overpaid tax from the previous year. The self assessment system encourages responsible financial behaviour, as it makes individuals accountable for their tax affairs. Furthermore, it assists HMRC in maintaining the integrity of the UK tax system by ensuring all income is declared.

Key Deadlines to Remember

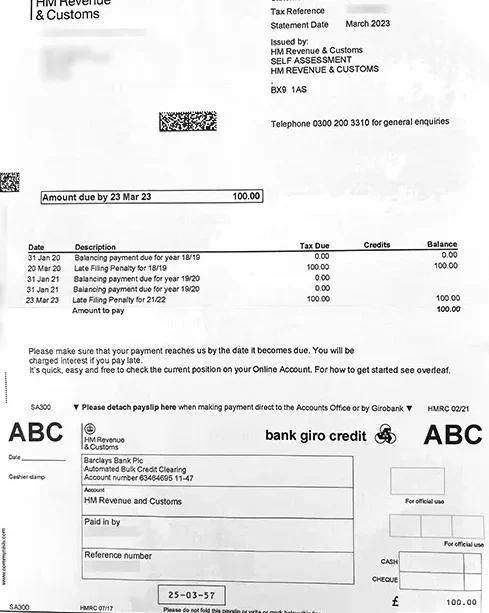

For the tax year running from April 6 to April 5, the critical deadlines for self assessment are as follows:

- Paper tax returns: Must be filed by October 31.

- Online tax returns: Must be completed by January 31 of the following year.

- Payment of tax: Any taxes owed must also be paid by January 31.

Missing these deadlines can result in fines and interest charges, so it’s vital for taxpayers to be organised.

How to Submit Your Self Assessment

Taxpayers can complete their self assessment online through the HMRC website or via paper forms. Those new to self assessment may find it beneficial to seek guidance from tax professionals or utilise HMRC’s resources, including online tools and helplines. Additionally, taxpayers should gather all relevant documentation regarding income and expenses to simplify the process.

Conclusion

Understanding HMRC self assessment is crucial for effectively managing one’s tax responsibilities in the UK. With the increasing number of self-employed individuals, being vigilant about compliance will not only prevent costly penalties but also contribute to the overall efficiency of the tax system. As deadlines approach, taxpayers should ensure they are prepared and informed, utilizing available resources to navigate the process successfully. Planning ahead can lead to smoother submissions and peace of mind during tax season.