Current Trends in Rolls Royce Share Price

Introduction

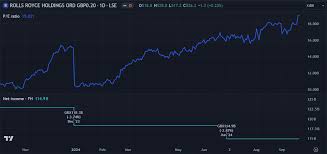

The share price of Rolls Royce Holdings plc has been a topic of significant interest for investors following the company’s strategic measures to recover from financial setbacks caused by the COVID-19 pandemic. As a prominent name in the aerospace and defence sectors, understanding its share price movements is crucial for stakeholders and prospective investors alike.

Recent Developments

As of October 2023, Rolls Royce’s share price has shown considerable volatility due to various factors including market conditions, company performance, and the broader economic environment. In recent weeks, the share price has been fluctuating around the £1.90 mark, reflecting investors’ sentiments regarding the company’s forecast for increased demand in the aviation sector.

The resurgence of air travel post-pandemic has bolstered expectations for Rolls Royce, as airlines are looking to revive operations, thus increasing demand for aircraft engines and maintenance services. The company has also reported a rising order book, suggesting a positive outlook for revenue growth. Investors have responded positively, resulting in an uptick in share price.

Analyst Predictions

Financial analysts are cautiously optimistic about Rolls Royce’s future. Many predict that with the gradual recovery of the airline industry and enhanced operational efficiency, the share price could experience upward momentum. A recent report from a financial services firm noted that stronger performance in the civil aerospace division could lead to a rise in the share price to between £2.00 and £2.50 within the next 12 months, depending on sustained recovery trends.

Challenges Ahead

Despite the positive outlook, there are concerns that could hinder prospective gains in share price. For one, inflationary pressures and rising fuel costs may affect airlines’ profitability, potentially dampening their expenditure on new aircraft. Additionally, international supply chain issues could impact Rolls Royce’s production capabilities, affecting delivery schedules and overall profitability.

Conclusion

The Rolls Royce share price remains fluid, influenced by both internal company performance and external market conditions. Investors are closely monitoring these dynamics as they assess the risks and opportunities associated with this leading aerospace manufacturer. With a potential for recovery and growth in the aviation sector, the coming months will be critical for the company’s share price trajectory. Stakeholders should remain attuned to ongoing developments in the industry to make informed decisions.