Current Trends and Insights on Nvidia Share Price

Introduction

The performance of Nvidia Corporation’s share price has become increasingly pivotal in the technology sector, particularly as the company continues to lead innovations in graphics processing units (GPUs) and artificial intelligence (AI). With a market capitalisation that has surpassed $1 trillion, Nvidia’s share price fluctuations are closely monitored by investors and analysts alike, underscoring the importance of understanding the factors that affect its valuation.

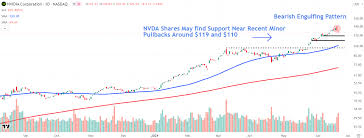

Recent Share Price Movements

As of mid-October 2023, Nvidia shares are trading at approximately £440 per share, reflecting a remarkable increase of over 150% compared to the same period last year. The surge in share price can be attributed to a combination of robust earnings reports, heightened demand for AI technologies, and strategic partnerships within the tech industry. The company’s recent earnings call revealed a 60% year-on-year increase in revenue, significantly driven by its data centre segment, which caters to the growing needs of cloud computing and AI development.

Factors Influencing the Share Price

Several key factors are influencing Nvidia’s share price today:

- AI Boom: The increasing adoption of AI technology across various sectors has led to a surge in demand for Nvidia’s GPUs, which are integral for training AI models. Major companies such as Google and Microsoft have expanded their partnerships with Nvidia, further underscoring the company’s essential role in the AI landscape.

- Supply Chain Dynamics: Challenges in semiconductor supply chains have also impacted Nvidia’s production capabilities. While the company has indicated strength in managing these challenges, any disruptions could lead to fluctuations in share price.

- Stock Market Sentiment: Global market trends and investor sentiment also play a significant role. With macroeconomic factors such as inflation and interest rates influencing tech stock performance, Nvidia’s share price may experience volatility based on broader market conditions.

Conclusion

In summary, Nvidia’s share price reflects not only its operational success but also the prevailing trends in technology and investor behaviour. As AI continues to revolutionise multiple industries, Nvidia is well-positioned for growth, which could lead to further increases in share price. However, external market conditions and supply chain issues represent potential risks that investors should watch closely. As Nvidia pushes the boundaries of innovation, the implications for its share price remain a topic of notable significance for both current and prospective investors.