The Current State of Inflation: Causes and Effects in 2023

Introduction

Inflation has become a central topic of discussion worldwide, particularly as economies recover from the disruptions caused by the COVID-19 pandemic. Understanding inflation is crucial as it affects purchasing power, cost of living, and the overall economic landscape. In 2023, inflation rates have shown significant fluctuations due to various factors, making an understanding of this phenomenon essential for policymakers, businesses, and consumers alike.

Current Inflation Trends

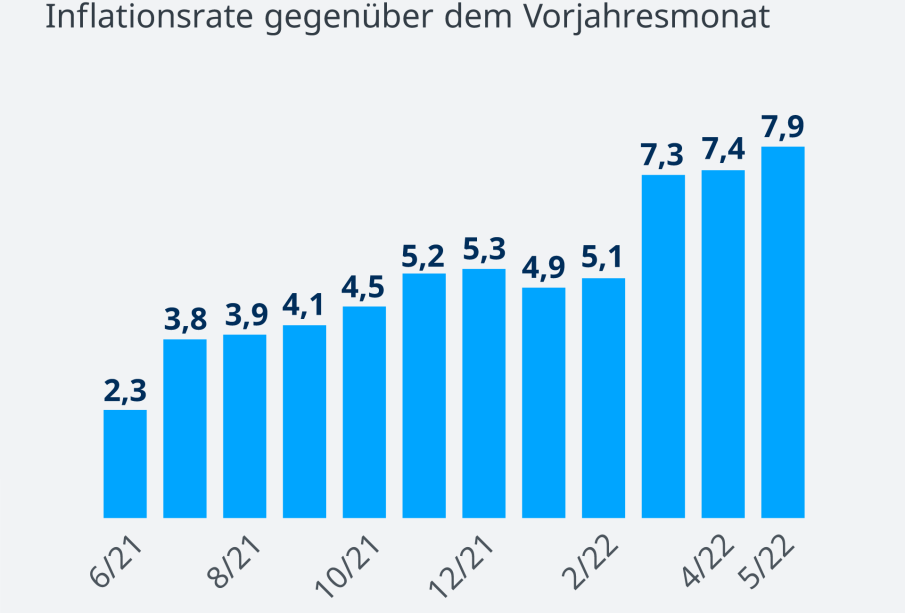

According to the latest data from the Office for National Statistics (ONS), the UK experienced an inflation rate of 6% in early 2023, a decrease from previous highs that approached double digits in 2022. This decrease can be attributed to several factors, including a stabilising energy market and supply chain recovery. However, inflation remains above the Bank of England’s target rate of 2%, indicating ongoing economic pressures.

Causes of Inflation

Multiple factors contribute to inflation, including:

- Supply Chain Disruptions: The impact of the pandemic continues, causing delays and increased costs in global supply chains.

- Energy Prices: While energy prices have stabilised somewhat, fluctuations still impact costs for consumers and businesses.

- Government Spending: Enhanced government spending to support economies during the pandemic has also contributed to the inflationary environment.

Impact on Consumers and Businesses

The persistent inflation rate affects consumer spending habits, with many households facing higher prices for everyday goods and services. Essentials like food, fuel, and housing have experienced steep price increases, prompting consumers to adjust their budgets accordingly. For businesses, maintaining profit margins has become increasingly challenging, leading many to consider price increases, which could further perpetuate the inflation cycle.

Conclusion

Looking ahead, economists and analysts will closely monitor inflation trends throughout 2023 to predict potential impacts on the economy and personal finances. While inflation seems to have peaked in some areas, the underlying issues contributing to this phenomenon remain prevalent. It is essential for policymakers to address these concerns carefully, as missteps could lead to unwanted economic consequences, including potential recession worries. For consumers, staying informed and adapting to these changes may be crucial for navigating the ongoing inflation landscape.