Understanding Tesco Share Price Trends in 2023

Introduction

The share price of Tesco, one of the UK’s largest supermarket chains, is a critical indicator of the company’s financial health and market position. As consumer behaviours shift and the retail landscape evolves, keeping an eye on Tesco’s share price is essential for investors and stakeholders alike. The significance of tracking these fluctuations extends beyond simple stock market analysis, impacting everything from investment strategies to consumer confidence.

Current Trends in Tesco’s Share Price

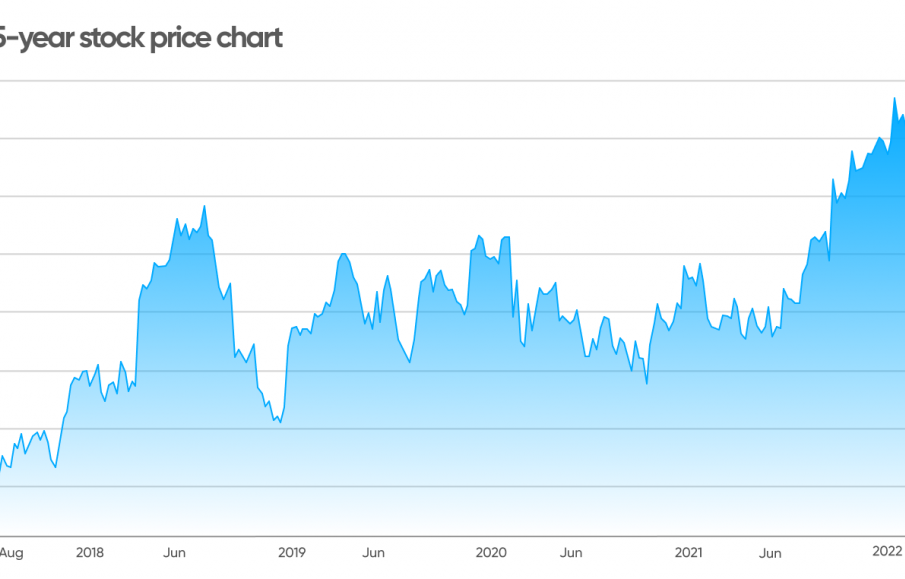

As of October 2023, Tesco’s share price has experienced notable fluctuations due to various factors, including changes in consumer spending, inflation rates, and ongoing competition in the retail sector. In September, the share price was reported at approximately £2.50, showing a slight increase from the previous month due to positive market sentiment stemming from strong quarterly earnings results.

Recent reports indicate that Tesco has successfully adapted to the demand for online shopping, which has been bolstered by the pandemic’s lasting effects. The company has invested significantly in its e-commerce capabilities, leading to an upturn in sales, particularly in non-food categories. This adaptation has been a vital factor contributing to the share price stability experienced in recent months.

External Factors Impacting Tesco’s Share Price

However, Tesco’s share price is not immune to external pressures. Economic factors such as rising inflation and increased costs in supply chain operations have the potential to weigh heavily on retail performance. Analysts have pointed out that while Tesco holds a strong position, ongoing price hikes on groceries might pressure margins and consumer spending. Furthermore, competitive pressures from discount retailers and changing consumer preferences towards sustainability can impact growth prospects.

Future Forecast and Investor Sentiment

Looking ahead, analysts remain cautiously optimistic about Tesco’s share price trajectory. With the company focusing on cost control measures and enhanced customer experience, it is expected that the share price could see gradual growth, provided market conditions stabilise. Investors are advised to stay alert to macroeconomic indicators, particularly regarding inflation and consumer confidence, which could significantly influence future performance.

Conclusion

Monitoring Tesco’s share price is crucial for understanding the company’s market dynamics and investment potential. As the retail landscape continues to shift, Tesco’s ability to adapt to consumer needs will play a pivotal role in its financial success moving forward. Investors and stakeholders should remain vigilant, considering both the opportunities and challenges that lie ahead in the rapidly evolving marketplace.