Understanding FTSE 100 Share Price Dynamics

Introduction

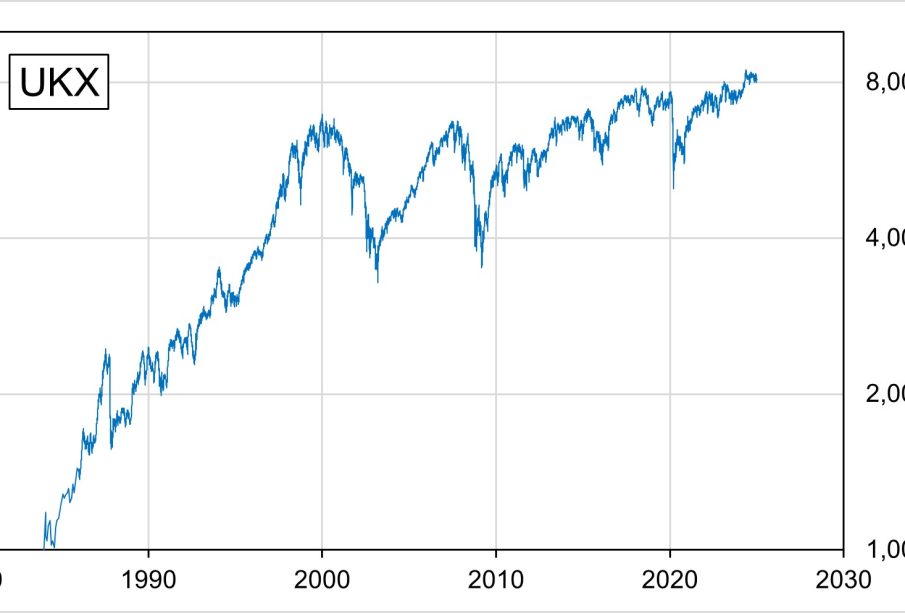

The FTSE 100, a benchmark index of the 100 largest companies listed on the London Stock Exchange, serves as a barometer of the UK economy and investment sentiment. With its fluctuations frequently reflecting broader economic conditions, understanding its share price movements remains crucial for both investors and economists alike.

Current Trends in FTSE 100 Share Price

As of mid-October 2023, the FTSE 100 has been experiencing notable volatility, closing at approximately 7470 points. This shift can be attributed to a multitude of factors, including inflationary pressures and economic growth forecasts. Recent data suggested that the Bank of England’s interest rate hikes, aimed at curbing inflation, have played a significant role in market reactions. Despite recent declines in inflation, the uncertainty around future rates continues to stir the market.

Furthermore, geopolitical tensions, particularly relating to the ongoing conflict in Ukraine and economic policies in China, have compounded the situation. For example, energy stocks saw increased activity amid fluctuating oil prices, which directly influenced the indices due to companies like BP and Shell playing a prominent role in the FTSE 100’s overall value. Analysts noted a rebound in technology and consumer goods sectors reflecting a nuanced investor approach towards risk in the current economic climate.

Analysts’ Opinions and Future Predictions

Market experts suggest that as we approach the end of the year, investor sentiment will heavily pivot around the forthcoming fiscal policies and earnings reports from major FTSE 100 constituents. Analysts from various financial institutions anticipate a volatile close to the year, with the FTSE 100 potentially navigating between 7300 and 7600 points depending on macroeconomic developments.

Conclusion

In summary, the FTSE 100 share price serves not just as a reflection of UK corporate health but also as a canvas depicting global economic sentiments. For investors, keeping a close watch on these fluctuations is paramount as they can guide strategic decisions concerning holdings and market entry. Moving forward, accurate predictions around the FTSE 100 will require a vigilant eye not only on domestic developments but also international affairs impacting major sectors.