Overview of HMRC Income Tax Allowance Increase

Introduction

The recent announcement regarding the increase in the HMRC income tax allowance signifies an important development for taxpayers across the United Kingdom. As inflation and living costs rise, this adjustment aims to provide some relief, particularly for low and middle-income earners. Understanding the impact of this change is vital for individuals planning their financial year ahead.

Details of the Allowance Increase

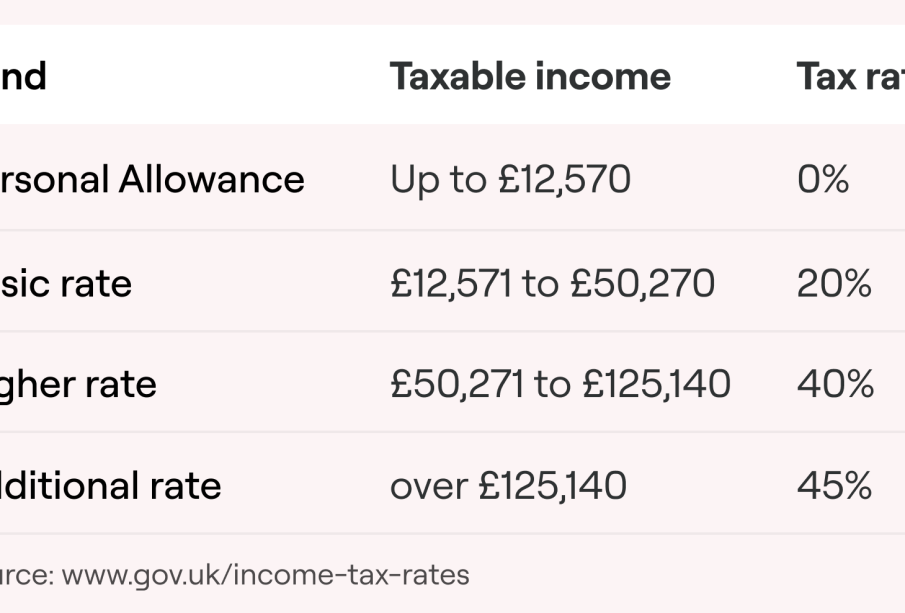

As part of the government’s strategy to alleviate the financial pressure faced by citizens, HMRC has announced that the personal income tax allowance will be raised from £12,570 to £13,000 for the tax year commencing April 2024. This adjustment reflects a £430 increase, a move that is projected to benefit about 5 million taxpayers nationwide. With the cost of living crisis impacting households, this increment is timely and necessary.

The increase means that individuals earning below £13,000 will not be subject to income tax, effectively allowing them to retain more of their earnings. For those with a marginally higher income, it may also reduce the amount of tax owed, contributing to increased disposable income.

Reactions and Implications

The announcement has garnered mixed reactions from various stakeholders. Tax experts have praised the increase as a long-awaited and necessary step that acknowledges the financial hardships many face. However, some argue that the rise should have been more substantial given the current economic climate. According to the latest figures from the Office for National Statistics, inflation remains high, adding pressure to wages and living expenses.

Moreover, the government is focusing on continuous measures to boost the economy as part of its broader fiscal policy. Alongside the income tax allowance increase, additional support measures such as energy price caps and subsidies for public services have been discussed, aiming to provide a comprehensive approach to financial relief.

Conclusion

In conclusion, the increase in HMRC income tax allowance comes as a beacon of relief for many individuals grappling with the ongoing cost of living crisis. As financial pressures persist, this adjustment is a welcome development, although it also leads to discussions about the adequacy of government intervention in supporting low and middle-income earners. Looking ahead, taxpayers are encouraged to review their financial plans for the upcoming tax year, taking into consideration the benefits of this increase. The broader implications for individual financial health and overall economic stability remain to be fully realized as we enter this new fiscal period.