Understanding National Insurance Contributions in the UK

Introduction

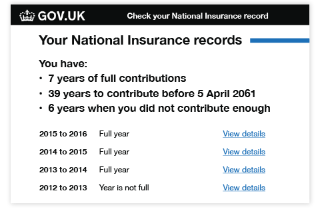

National Insurance Contributions (NICs) are vital for the social security framework of the United Kingdom. They fund essential services such as the National Health Service (NHS), pensions, and various social benefits. Understanding NICs is crucial not only for employees and employers but also for self-employed individuals, as these contributions directly impact benefits received during retirement or periods of unemployment.

What Are National Insurance Contributions?

NICs are payments made by workers and employers in the UK, primarily used to fund state benefits. The contributions are categorized into several classes; the most significant are Class 1 contributions made by employees and employers, Class 2 contributions paid by self-employed individuals with a profits threshold, and Class 4 contributions for higher earnings by self-employed workers. Each class serves different purposes regarding benefit entitlements.

Recent Changes and Current Rates

As of the 2023-2024 tax year, employees pay 13.25% on earnings between £12,570 and £50,270 and 3.25% on income above £50,270. Employers also pay a 13.8% contribution on employee earnings exceeding £9,100. Self-employed individuals contribute a flat fee of £3.15 a week for Class 2 contributions, and Class 4 contributions are charged at 9% on profits between £12,570 and £50,270, with a higher rate of 2% on profits above this level. These rate changes have come into effect amid rising costs and the need for increased funding for public services.

The Importance of National Insurance Contributions

NICs are fundamental to ensuring financial stability in retirement and access to state benefits when needed. They provide a safety net for individuals during unpredictable circumstances such as unemployment or health issues. Moreover, NICs play a significant role in the economy, as they help fund public services that benefit the entire population. Recent discussions in Parliament suggest potential reforms to further reflect the changing nature of employment and the gig economy, where more individuals may not fit traditional payment categories.

Conclusion

The significance of National Insurance Contributions extends beyond mere payments; they represent a commitment to mutual support within society. As the government faces increasing pressure to adapt to economic changes, NICs will likely remain a topic of ongoing discussion and potential reform. For UK citizens, staying informed about their contributions can ensure they maximize their entitlements while contributing to the well-being of the nation. Monitoring changes and understanding how NICs work will be crucial for future financial planning.