Understanding the Latest Bank of England Interest Rate Changes

Importance of the Bank of England Interest Rate

The interest rate set by the Bank of England (BoE) is a crucial tool in managing the UK economy. It influences borrowing costs, consumer spending, and overall economic activity. Recent fluctuations in this rate have raised questions among economists and the general public, making it a topic of great relevance.

Current Interest Rate Situation

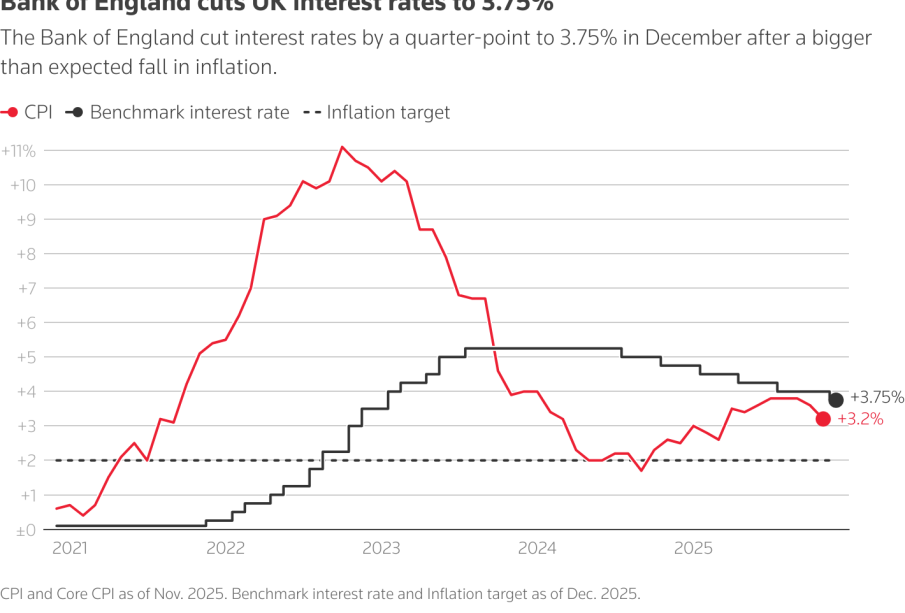

As of October 2023, the Bank of England has maintained its interest rate at a historical peak of 5.25%. This decision, announced during the latest Monetary Policy Committee (MPC) meeting, was largely influenced by persistent inflationary pressures exceeding the target rate of 2%. The BoE aims to curb soaring prices, which have affected household budgets and business costs alike. Economic analysts noted that inflation in the UK was reported at 6.3% year-on-year in September, down from previous highs, but still significantly above comfort levels.

Impact on the Economy

The impact of this sustained interest rate affects various sectors. Mortgages, for instance, have become more expensive for homeowners, leading to increased monthly repayments. Small to medium enterprises (SMEs) face higher borrowing costs, influencing their growth strategies and investment possibilities. Conversely, savers may benefit from improved interest earnings on deposits, a silver lining for those looking to build financial security.

Future Predictions and Conclusion

Economists are divided on future rate adjustments. Some anticipate gradual reductions in response to stabilising inflation figures, while others fear that volatility in global markets and rising wage demands may keep pressure on rates. The next MPC meeting is scheduled for early November 2023, where further insight will be provided on potential changes. As readers consider their financial strategies, awareness of the BoE’s interest rate policies is essential for informed decision-making in both personal and business finance.