What You Need to Know About Car Tax Changes in the UK

Introduction

The UK government has announced significant changes to car tax regulations, set to take effect from April 2024. This decision has generated considerable discussion among drivers, environmentalists, and industry experts, as it aims to encourage a shift towards environmentally friendly vehicles and tackle rising emissions. Understanding these changes is crucial for both current and prospective vehicle owners.

Details of the Changes

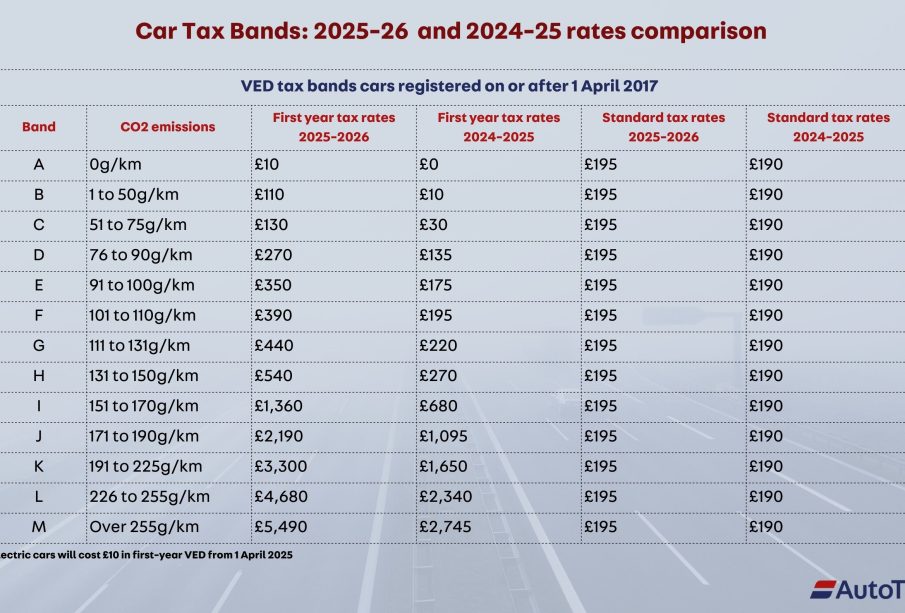

The new regulations will introduce a tiered tax system based on emissions, which will affect all new cars registered after that date. Vehicles emitting over 120 grams of CO2 per kilometre will face an increase in their annual tax rate, while those below this threshold will see a reduction. For electric vehicles, which emit no CO2, the tax will be scrapped altogether, serving as an incentive to adopt greener options.

In the previous scheme, many drivers faced a flat rate irrespective of the emissions produced; however, this change aims to more accurately reflect the environmental impact of cars, promoting cleaner technologies. According to the Department for Transport, the new system is estimated to reduce overall vehicle emissions by up to 15% by 2030.

The Impact on Drivers and the Economy

The alteration in car tax has various implications for drivers. Many households may find the cost of owning a petrol or diesel vehicle rising, potentially pushing them to consider electric or hybrid alternatives. The Society of Motor Manufacturers and Traders (SMMT) estimates that these incentives could lead to a 25% increase in electric vehicle sales over the next few years.

While these changes present financial challenges for some, they could stimulate job growth in the green technology sector as demand for electric vehicles rises. Moreover, the government is expected to develop charging infrastructure across urban areas to support this transition, which would provide economic opportunities for businesses involved in this sector.

Conclusion

The upcoming car tax changes represent a significant shift in the UK’s approach to vehicle emissions, prioritising environmental sustainability while ensuring that drivers are aware of their responsibilities. As the transition approaches, it is critical for drivers to stay informed about how these changes will affect their current and future vehicle choices. By embracing these changes, the UK aims to achieve its ambitious carbon reduction targets and improve air quality for future generations.