US inflation rate steady at 2.7% in December 2025

Introduction: Why the US inflation rate matters

The us inflation rate is a key economic indicator that affects household budgets, business planning and central bank policy. Persistent changes in inflation influence interest rates, real wages and the cost of borrowing. Monitoring the measure helps consumers and policymakers assess whether price pressures are easing or building, and whether monetary policy adjustments may be required.

Main developments and data

Latest official reading

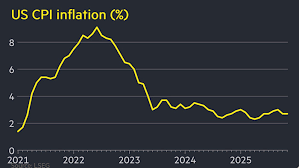

According to U.S. Labour Department data, the annual inflation rate in the United States was 2.7 per cent for the 12 months ending December 2025, unchanged from the prior reading. This figure represents the headline consumer price index (CPI) measure commonly cited in economic commentary and policymaking.

Core inflation and short-term movement

Core inflation, which excludes volatile food and energy prices, was reported at 2.6 per cent year on year for December 2025. Monthly movement for December showed a 0.3 per cent increase, indicating modest month‑to‑month price pressure. These components give a fuller picture of underlying inflation trends beyond headline volatility.

Context and historical perspective

Trading Economics notes that the long‑run average inflation rate in the United States was about 3.29 per cent from 1914 until 2025. By comparison, the series has seen extreme moves in the past, with an all‑time high of 23.70 per cent in June 1920 and a record low of -15.80 per cent in June 1921, reflecting exceptional historical episodes rather than contemporary conditions.

Conclusion: What this means for readers

The current us inflation rate of 2.7 per cent suggests that price growth has moderated from the higher rates seen earlier in the decade. Market models and analysts tracked by Trading Economics expect inflation to edge slightly lower to around 2.6 per cent by the end of the quarter. For households, businesses and investors, this moderation may signal a period of relative price stability, though small month‑to‑month increases underline the need to watch incoming data. Policymakers will weigh these readings alongside labour markets and other indicators when considering future interest‑rate decisions. Ongoing monitoring of CPI releases remains important for those planning budgets or financial strategies.