Updates on the Peter Sullivan Case: What You Need to Know

Introduction

The Peter Sullivan case has garnered considerable attention in recent weeks, becoming a focal point in both legal circles and media discussions. This case, involving allegations of financial misconduct and potential repercussions for public trust in corporate governance, underscores the importance of accountability and transparency in business practices.

Background of the Case

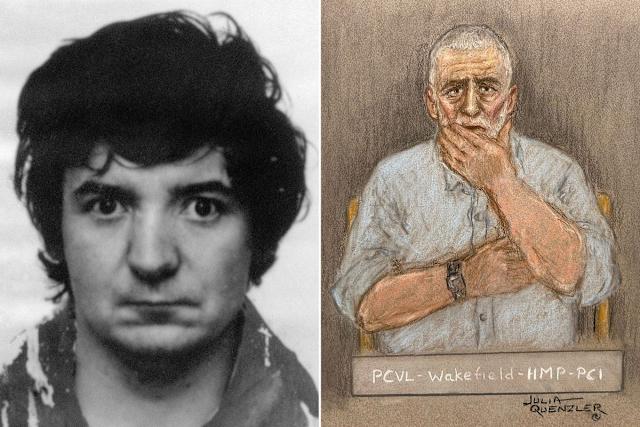

Peter Sullivan, a prominent figure in the financial sector, was accused of engaging in activities that led to significant financial losses for investors amid allegations of fraud. The case came to light when a whistleblower reported irregularities in Sullivan’s financial dealings, prompting an investigation by regulatory bodies and law enforcement. Sullivan, who has denied all allegations, claims that the accusations stem from personal vendettas and misunderstandings between business associates.

Recent Developments

As of October 2023, the investigations into the allegations against Peter Sullivan are ongoing. Key developments include the release of documents that purportedly show a trail of misleading financial practices linked to Sullivan’s company. Regulators are reviewing these documents, with findings expected to be presented in the upcoming court hearings scheduled for November.

Moreover, a group of investors who lost money due to the alleged fraud has initiated a class-action lawsuit against Sullivan, seeking restitution for their losses. Legal experts suggest that this civil case could influence the ongoing criminal investigation, as mounting evidence and investor testimonies might sway public perception and judicial outcomes.

Implications and Significance

The Peter Sullivan case serves as a stark reminder of the importance of ethical practices in the financial industry and the profound impact of misconduct on ordinary investors. Legal experts highlight that the outcomes of this case could lead to stricter regulations and oversight for financial professionals, shaping future practices within the industry.

Conclusion

As developments in the Peter Sullivan case unfold, stakeholders from investors to regulatory bodies are keenly observing the proceedings. The eventual outcomes not only hold significant implications for those directly involved but also serve as a pivotal moment in setting precedents for accountability and ethical standards in business operations. With the next court date approaching, it remains crucial for the public to stay informed and aware of the broader implications of this high-profile case.