Understanding UK House Prices: Current Trends and Future Outlook

The Importance of Monitoring UK House Prices

In the wake of economic shifts and changing consumer behaviours, understanding UK house prices has become increasingly important for potential homebuyers, investors, and policymakers. House prices significantly influence economic stability, affordability, and housing supply, making it crucial to keep track of current trends.

Current Trends in UK House Prices

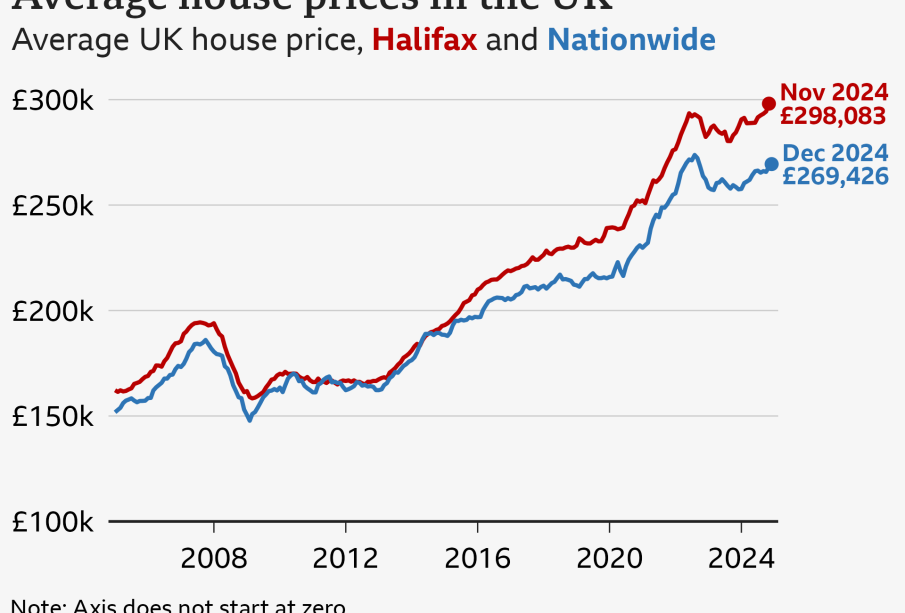

As of late 2023, UK house prices have shown signs of stabilisation following a period of volatility triggered by the global pandemic and subsequent economic recovery efforts. According to the latest data from the Nationwide Building Society, the average house price in the UK has increased by approximately 2.3% over the last year, reaching £267,000 as of September 2023. This is a subtle increase compared to the rapid growth witnessed during the pandemic, where prices surged by nearly 20% in some areas.

However, regional disparities remain prominent. The North East of England has seen slower growth, while London and the South East continue to outpace the national average. The Office for National Statistics reported a year-on-year increase of 4.1% in London, attributed to high demand and limited housing supply.

Factors Influencing House Prices

Various factors are influencing these current trends, including rising interest rates, inflation, and changes in government policy. The Bank of England’s tightening of monetary policy, increasing interest rates to combat inflation, has raised borrowing costs for potential homebuyers. This has led to a cooling effect in the housing market, particularly among first-time buyers who often struggle with affordability.

Furthermore, the end of the temporary stamp duty relief and increased living costs have added pressure on buyers, causing transactions to decline in some sectors. As per reports, property transactions fell by approximately 12% in comparison to 2022, indicating a potential slowdown in the market.

The Future of House Prices in the UK

Looking ahead, many experts predict a generally stable market with moderate growth. The ongoing conflict in Ukraine, economic uncertainty, and the challenges posed by climate change will also play a role in shaping market dynamics. The National Association of Estate Agents has suggested that if inflation stabilises and the economic outlook improves, we may see a moderate recovery in demand and house prices towards the end of 2024.

Conclusion

Understanding UK house prices is more essential than ever in today’s fluctuating market. Homebuyers and investors must consider both current trends and future forecasts when making decisions. As the housing market continues to adapt to economic changes, staying informed will be key to navigating this complex landscape successfully.