Understanding Trends in Tesla Share Price

The Importance of Tesla Share Price

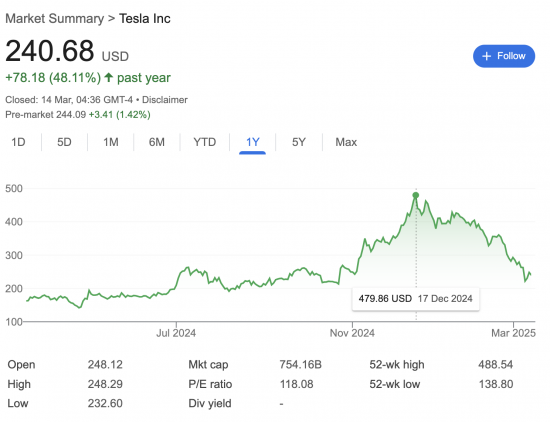

The Tesla share price is a pivotal indicator for investors and stakeholders in the automotive and technology sectors. As one of the most recognisable brands in electric vehicles, Tesla’s stock performance not only reflects the company’s health but also offers insights into the broader market trends, especially in sustainability and innovation.

Current Share Price Dynamics

As of late October 2023, Tesla’s share price has experienced notable volatility, primarily influenced by market reactions to its quarterly earnings reports and broader economic conditions. The most recent earnings report exceeded expectations, showcasing a 25% increase in revenue compared to the previous quarter. This positive financial performance was met with a slight uptick in the share price, which rose to approximately £200 per share, up from £185 earlier this month.

Market Factors Affecting Tesla’s Share Price

Several factors are contributing to the ongoing fluctuations in Tesla’s stock. Firstly, the global demand for electric vehicles remains strong, driven by government incentives and increasing consumer awareness about climate change. Additionally, Tesla continues to expand its production capabilities, with new factories expected to come online in several markets, including Europe and India.

However, challenges remain on the horizon. Macroeconomic factors such as inflation and interest rate hikes by central banks are creating a cautious environment for investors. High inflation rates have led to increased costs for raw materials, which may impact future profit margins and, subsequently, the share price. Moreover, growing competition from traditional auto manufacturers entering the electric vehicle space poses a significant threat to Tesla’s market share.

Comparative Analysis with Competitors

In 2023, Tesla competes with manufacturers like Rivian, Lucid Motors, and legacy automakers like Ford and General Motors, all of whom are ramping up their electric vehicle offerings. A comparison of stock performances reveals that while Tesla holds a dominant position, other companies are rapidly gaining traction, thereby exerting pressure on Tesla’s valuation.

Conclusion and Future Outlook

Looking ahead, the Tesla share price will likely remain subject to fluctuations based on the company’s ability to adapt to market conditions, manage production costs, and maintain its competitive edge. Analysts predict that if Tesla continues to deliver strong production and sales figures, its stock could see an upward trend. However, investors should be wary of the dynamic and ever-evolving landscape of the automotive industry.

For those considering investing in Tesla, it is crucial to stay informed about market trends and company developments to make educated decisions. Monitoring economic indicators and staying updated on Tesla’s strategic moves will be essential in navigating potential risks and rewards.