Understanding the UK State Pension in 2023

Introduction

The UK State Pension is a crucial part of the retirement strategy for millions of people in the United Kingdom. It provides a financial foundation for retired individuals, ensuring that they have a steady income to support their living expenses. In 2023, the State Pension has been under scrutiny due to changes in eligibility age and the amount entitled to retirees, making it essential for current and future pensioners to be informed about their rights and benefits.

Current State Pension Overview

As of April 2023, the full new State Pension stands at £203.85 per week for those who reached their State Pension age on or after 6 April 2016. In comparison, those who qualified for the old State Pension, which is based on different criteria, receive between £141.85 and £203.85 weekly, depending on their National Insurance contributions. The UK Government’s decision to increase the pension amount in line with the Consumer Price Index (CPI) means that pensioners will enjoy a modest rise to combat the cost-of-living crisis.

Changes and Eligibility

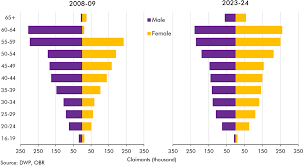

The State Pension age has been gradually increasing over the past decade and will continue to do so. Currently, the pension age is 66 for both men and women, and it will rise to 67 between 2026 and 2028. This change affects individuals who are currently near retirement age and creates uncertainty about when they will actually receive their pension. It’s vital for those approaching retirement to check their State Pension age on the UK Government website to avoid any surprises.

Impact of Economic Changes

The ongoing economic challenges due to inflation and rising living costs have put immense pressure on pensioners, many of whom depend solely on the State Pension. Recent surveys show that a significant portion of retirees struggle to meet basic expenses, with household bills eating up a substantial part of their income. The UK Government has acknowledged these challenges, and there are ongoing discussions regarding potential reforms to the pension system to better support individuals in their later years.

Conclusion

The UK State Pension plays an integral role in providing financial security to retirees. With the adjustments to the amount and eligibility requirements in 2023, it is crucial for current and future pensioners to stay engaged and informed about their rights. As economic conditions continue to evolve, potential reforms are likely, which may alter the landscape of pensions in the UK. For those nearing retirement, understanding these changes is necessary to ensure a secure financial future.