Understanding the UK State Pension: Current Status and Future Outlook

Introduction

The UK State Pension is a crucial financial support system for millions of retirees across the country. It plays a significant role in ensuring that citizens can maintain a basic standard of living upon retirement. Understanding the intricacies of this system, including its recent reforms and future implications, is essential for both current and future pensioners.

Current State of the UK State Pension

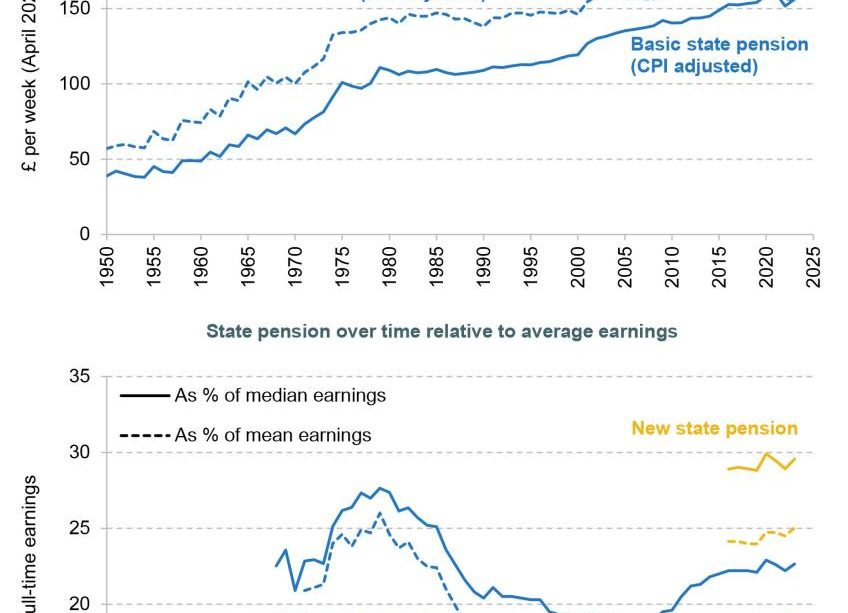

The UK State Pension was reformed in 2016, introducing a flat-rate pension aimed at simplifying the benefits structure. Currently, the full new State Pension is £203.85 per week for those reaching pension age on or after 6 April 2016. Approximately 12.8 million people are receiving their State Pension, contributing to their ongoing financial security in old age.

Future Projections

Experts suggest that the UK State Pension system faces several challenges ahead, particularly regarding its sustainability in light of an aging population. The ratio of working-age individuals to retirees is decreasing, which may lead to financial strains on the system. According to the Office for Budget Responsibility (OBR), the cost of the State Pension is expected to rise from approximately 5% of GDP in 2021 to around 6.3% by 2060.

Furthermore, the government is considering plans to increase the State Pension Age (SPA). Currently, the SPA is set to rise to 67 between 2026 and 2028, with discussions underway about potentially increasing it to 68 by the mid-2030s. Any such changes will significantly impact future retirees and necessitate careful planning.

The Importance of the State Pension

The State Pension is a cognitive part of the UK social security framework. It not only provides financial support but also reduces poverty rates among the elderly population. Approximately 60% of pensioners rely on the State Pension as a major source of their income, making it a fundamental element in the overall economic stability of many households.

Conclusion

In conclusion, the UK State Pension remains a vital aspect of financial security for retirees in the UK. As the country grapples with the challenges posed by demographic shifts and economic pressures, understanding the current structure and future changes to the State Pension is essential. It is imperative for future retirees to stay informed and engage in personal financial planning to mitigate any potential impacts of the evolving State Pension landscape.