Understanding the Triple Lock State Pension Increase

Introduction

The triple lock state pension increase is a crucial element of financial security for millions of retirees in the United Kingdom. Instituted in 2010, the triple lock guarantees that the state pension rises each year by the highest of three measures: inflation, average wages, or 2.5%. This system is designed to provide pensioners with a reliable income that keeps pace with cost-of-living increases, ensuring that they do not fall behind economically.

Recent Developments

As of November 2023, the UK government has confirmed that the state pension will increase by 8.5% in April 2024, following the latest inflation data. This substantial rise reflects the ongoing economic challenges faced by many in the wake of the COVID-19 pandemic and subsequent inflation spikes. For the 2023/24 financial year, the full new state pension will rise to approximately £203.85 per week, while those receiving the basic state pension will see their payments increase to around £156.20 per week.

The increase comes as many retirees have faced rising costs, especially in essential items such as food and energy. The pension uplift is projected to provide an additional £900 per year for pensioners, which is expected to have a significant positive impact on their living standards.

Controversy and Challenges

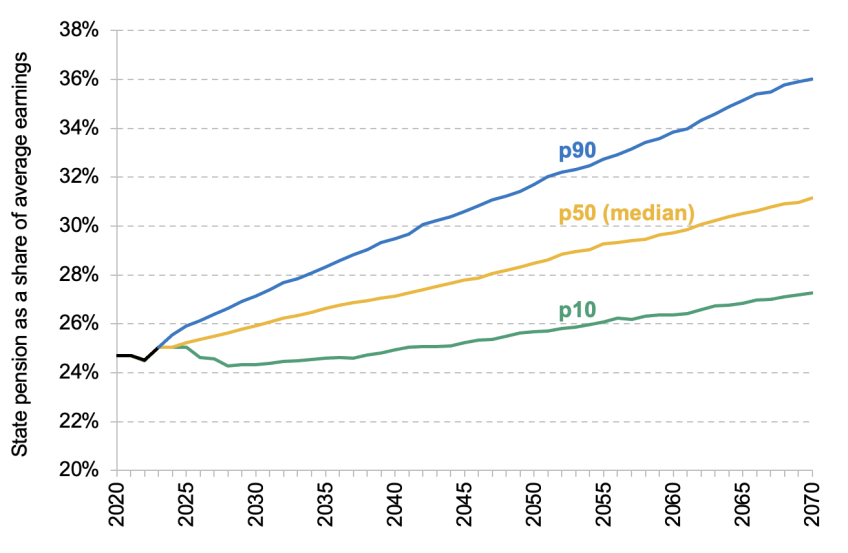

Despite the benefits of the triple lock, the policy has generated significant debate in UK politics. Critics argue that the system is financially unsustainable and adds significant pressure to the national budget, especially as the population ages and the number of retirees grows. Some proposals have been made to modify or suspend the triple lock during periods of high inflation, citing the need for fiscal prudence.

Conclusion

The triple lock state pension increase remains a pivotal factor in the financial well-being of the elderly population in the UK. While the forthcoming increase is positive news for many, ongoing discussions regarding the sustainability of the triple lock highlight the challenges that lie ahead. As the government grapples with economic constraints, future adjustments to this policy may be inevitable. Pensioners and their advocates must remain vigilant and engaged in discussions about the sustainability of the triple lock to ensure financial security in the years to come.