Understanding the State Pension Age in the UK

Introduction

The State Pension Age (SPA) in the UK is a crucial aspect of the country’s social security system, determining when individuals are eligible to receive their pension payments. Recent conversations surrounding changes to the SPA have gained significant attention as the government seeks to address the growing pressures on the pension system amid increasing life expectancies and demographic shifts. Understanding the current state pension age and anticipated changes is vital for current and future retirees in planning their financial futures.

Current State Pension Age

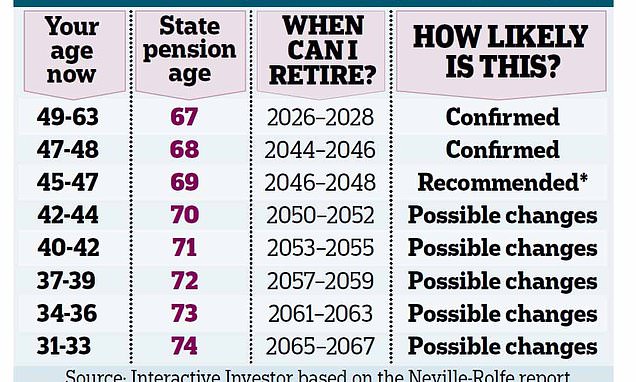

As of October 2023, the State Pension Age for both men and women in the UK stands at 66 years. This marks a gradual increase from previous ages, which were set at 65 for men and 63 for women. The government plans to raise this age further to 67 between 2026 and 2028, with proposals to extend it to 68 by 2039. These incremental adjustments are designed to reflect longer life expectancy trends, as the average life expectancy in the UK has risen significantly over the last few decades.

Government Proposals and Public Response

The UK government is currently reviewing its pension policies and has initiated discussions around potentially accelerating changes to the State Pension Age, moving the age to 68 sooner than previously planned due to economic pressures exacerbated by the COVID-19 pandemic and the rising cost of living. A recent consultation revealed mixed opinions among the public; while some support the changes to ensure sustainability of the pension system, others argue that rapid increases could disproportionately affect those in physically demanding jobs or with health issues.

Forecast and Implications for Future Retirees

For those approaching retirement or currently in the workforce, the spectre of increasing the State Pension Age presents crucial financial planning challenges. Retirees may need to adjust their savings and retirement plans, balancing the need to work longer against the health and job market realities. Financial advisors are urging individuals to consider alternative retirement income sources, such as personal pensions or investments to supplement their income as the SPA evolves.

Conclusion

The conversation regarding the State Pension Age in the UK continues to unfold, with significant implications for millions of workers and their retirement planning. With potential changes on the horizon, it is essential for individuals to stay informed and proactive in their retirement strategies. As the government navigates the complexities of pension sustainability, the dialogue around the State Pension Age underscores the broader issues of demographic shifts and economic stability, highlighting the ongoing need for public engagement and review of these policies.