Understanding the State Pension Age in the UK

Introduction

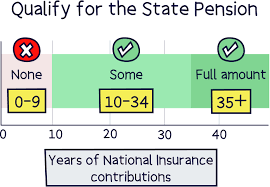

The state pension age is a pivotal issue affecting millions of citizens in the United Kingdom. It determines when individuals can begin receiving their state pension payments after years of contribution to the National Insurance. As life expectancy increases and the government’s budgetary needs change, understanding and navigating the alterations to the state pension age has never been more relevant for workers and retirees alike.

Recent Changes to State Pension Age

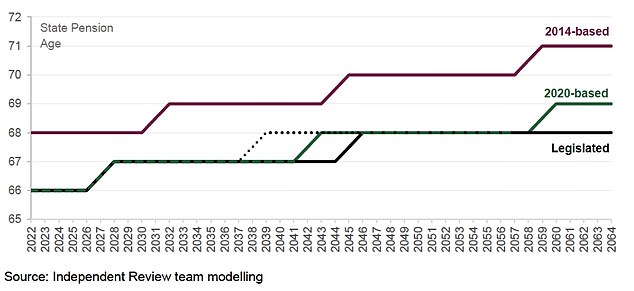

In recent years, the state pension age has undergone significant adjustments. Defined by the Pensions Act of 2014, the state pension age for both men and women is gradually increasing. Currently, the state pension age stands at 66, with plans to raise it to 67 between 2026 and 2028, and eventually to 68 by 2039. These changes are part of a strategy intended to adapt to increased life expectancy within the UK population, ensuring the sustainability of the pension system.

Impact on Future Retirees

The impact of the changes to the state pension age is considerable. Many people nearing retirement age have expressed concern over having to work longer before they can access their pensions. According to a survey conducted by Age UK, around 47% of respondents aged 60 and above believe that changes to the state pension age are unfair. The potential for financial strain on those who expected to retire earlier also raises questions about the support available for older workers to remain in the workforce.

Government Reactions and Future Outlook

In response to concerns raised by the public and various advocacy groups, the government has been urged to consider flexibility in the retirement age, allowing workers to retire earlier with reduced benefits if they choose. Discussions about how to adapt the workplace for aging employees, including flexible hours and training programmes, are also becoming increasingly necessary. With debates ongoing, some analysts predict that the state pension age could face further adjustments depending on public sentiment and economic needs.

Conclusion

The state pension age is more than just a number; it is a significant factor that shapes financial planning and retirement for millions. As changes continue to unfold, both prospective retirees and current workers need to stay informed and prepare for the implications these adjustments may have on their lives. Whether the age will move higher or there will be a push for reforms, staying abreast of these developments is vital as we navigate the complexities of retirement in the UK.