Understanding the State Pension Age in the UK

Introduction

The state pension age in the UK is a critical issue, particularly for those nearing retirement. It determines when individuals are eligible to receive their state pension, a vital source of income for many during their post-work years. Recent governmental proposals and adjustments have raised concerns and discussions about how these changes affect the workforce and the economy.

Current State of the Pension Age

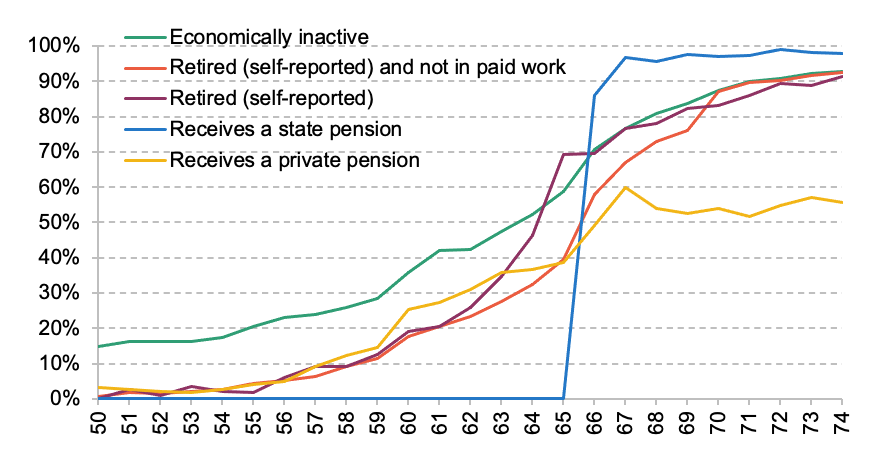

As of 2023, the state pension age in the UK stands at 66 for both men and women, having been raised from 65 in recent years. Plans to further increase the pension age to 67 are set to take place between 2026 and 2028, with discussions highlighting a potential increase to 68 by the mid-2030s. These changes are part of a broader effort to address an aging population and increasing life expectancy, which puts pressure on the pension system.

Impact of Changes

Raising the state pension age has practical implications for millions. Individuals must adapt their retirement plans, often working longer than previous generations. This transition may affect financial stability and health, particularly for those in physically demanding jobs who may struggle to work longer. Critics argue that these changes disproportionately impact those in lower-income brackets or jobs with shorter life expectancies.

Government Response and Public Sentiment

The government maintains that these adjustments are necessary to ensure the sustainability of the pension system. However, public sentiment reflects concern and frustration. Campaigns urging a reconsideration of the measures have gained traction, particularly among younger cohorts who may feel burdened by the uncertainty of future pensions. Data from recent surveys show that a significant portion of the population is anxious about their retirement plans under the current trajectory of pension age adjustments.

Conclusion

The changes to the state pension age are significant, affecting not only retirees but also the workforce at large. As the debate continues, stakeholders from various sectors must engage in discussions about finding a balance that considers economic sustainability while prioritising the livelihood of future retirees. Looking ahead, it will be essential for those impacted to stay informed about these changes and explore their options for retirement planning amid evolving policies. The consideration of additional reforms may be necessary to address the diverse needs of the population as we move into an uncertain economic future.