Understanding the State Pension Age 67

Introduction to State Pension Age 67

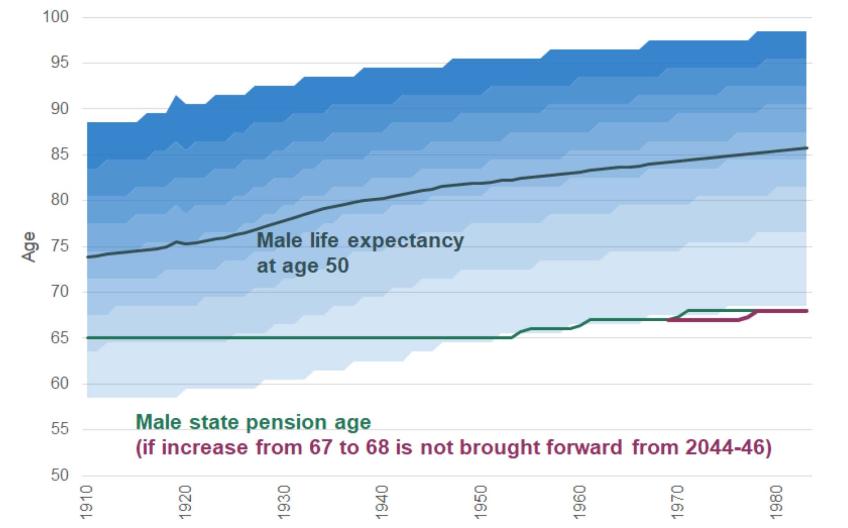

The state pension age is a crucial aspect of retirement planning for many citizens in the United Kingdom. It determines when individuals are entitled to receive their state pension, which plays a significant role in financial security during retirement. As the UK faces demographic shifts and increased life expectancy, the government has proposed adjustments to the state pension age, with the current legislation setting it at 67.

Current Legislation and Changes

Currently, under the Pensions Act 2014, the state pension age is set to increase gradually from 66 to 67 between 2026 and 2028. Initially, this change was indicated to occur between 2024 and 2026, but the adjustment was postponed to allow for a more extensive evaluation of the impact on the ageing population and workforce participation. With this change, individuals born between 6 April 1960 and 5 March 1961 will reach the state pension age of 67.

Demographic Considerations

The increase in the state pension age reflects shifting demographics in the UK. Advances in healthcare and living standards mean people are living longer, raising concerns over the sustainability of the pension system. The Office for National Statistics (ONS) projects that by 2039, there will be an estimated 15 million people aged over 65 in the UK. This significant increase will put additional pressure on the country’s pension system and public finances.

Public Sentiment and Challenges

Changes to the state pension age often evoke strong reactions from the public. Many express concerns about the implications this has for those who may have physically demanding jobs or poor health. Campaigns have emerged advocating for more equitable treatment for individuals nearing retirement age, calling for a more gradual transition or the introduction of flexibility based on personal circumstances. The debate continues over whether the state pension age should be adjusted further in the coming years in response to ongoing demographic changes.

Conclusion and Future Implications

As the state pension age increases to 67, it is essential for individuals to reassess their retirement plans and financial readiness. Awareness of the timetable and implications can help in making informed decisions regarding savings and investments. Looking ahead, the government will need to consider the balance between fiscal sustainability and the welfare of the ageing population, as further adjustments may be necessary. Citizens are encouraged to remain engaged in discussions about pension policies, as these decisions will significantly influence future generations.