Understanding the S&P 500 Index: Trends and Implications

Introduction to the S&P 500

The S&P 500 index is crucial for investors as it provides a comprehensive snapshot of the US stock market’s performance. Composed of 500 of the largest publicly traded companies in America, the S&P 500 serves as a benchmark for fund performance and market trends, making it a focal point for analysts and investors alike. Tracking its trends is essential for understanding broader economic conditions and potential investment strategies.

Recent Trends in the S&P 500

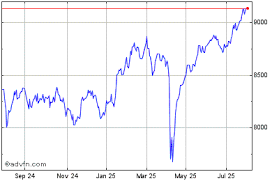

As of late September 2023, the S&P 500 has experienced notable fluctuations. Following a strong 2022, where technology stocks like Apple and Amazon led significant gains, 2023 has proven more volatile. After a rally during the first half, driven by hopes of a soft landing for the economy and robust corporate earnings, the index faced fresh challenges amidst rising inflation rates and concerns over interest rates increment by the Federal Reserve.

On September 22, 2023, the S&P 500 closed at approximately 4,405 points, reflecting a loss of around 5% from its peak earlier in the summer. The market has been reacting to mixed economic signals, including employment data and consumer spending patterns, which continue to keep investors on edge.

Factors Influencing the S&P 500

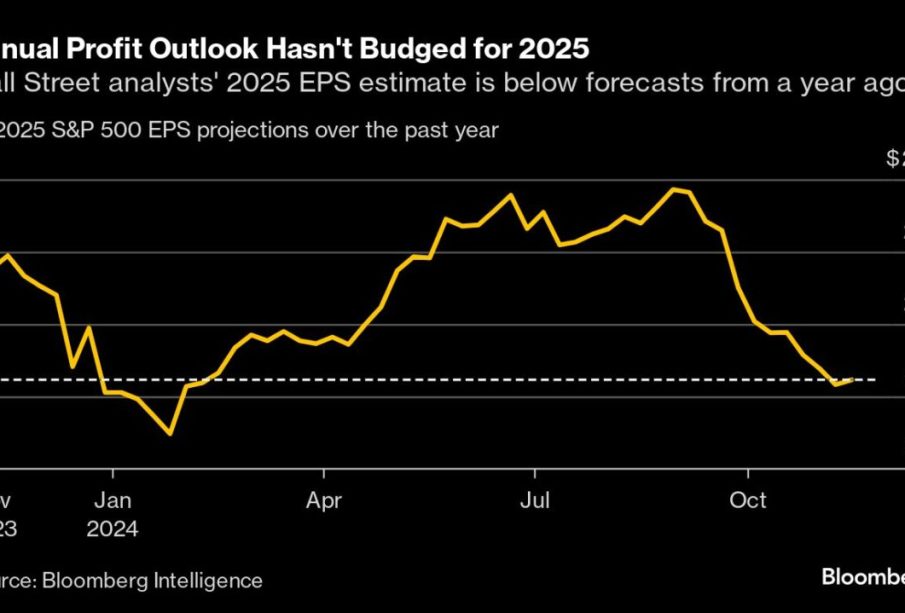

Several key factors are currently influencing the S&P 500’s trajectory. Firstly, inflation remains a critical concern. According to the Bureau of Labor Statistics, the inflation rate is projected to be around 4.5% this year, affecting consumer sentiment and spending. Secondly, the Federal Reserve’s monetary policy, particularly their approach to interest rates, is under scrutiny. With many economists predicting another rate hike, the cost of borrowing could impede growth for companies listed in the index.

Additionally, geopolitical tensions, particularly those involving energy prices and trade policies, exert pressure on the market. Companies in sectors such as energy and technology continue to be closely monitored as they navigate these challenges. Overall, investor sentiment remains cautious, underscoring the unpredictable nature of the current market environment.

Conclusion

In conclusion, the S&P 500 remains a critical indicator of economic health and investment opportunities in the US market. As we move towards the end of 2023, understanding the various influences affecting this index will be key for investors looking to adapt to market changes. With ongoing fluctuations and economic uncertainties, the S&P 500’s performance in the coming months will be vital for shaping market outlooks and investment strategies. Investors are advised to stay informed and consider diversification to mitigate risks associated with market volatility.