Understanding the Role of the Bank of England in the Economy

Introduction

The Bank of England, established in 1694, plays a crucial role in the United Kingdom’s financial system. As the central bank, it regulates the nation’s currency, manages monetary policy, and aims to maintain financial stability. Its actions are vital in addressing inflation and supporting economic growth, especially during uncertain times. In recent months, the Bank has been in the spotlight due to rising inflation rates and the ongoing economic impact of the COVID-19 pandemic alongside geopolitical tensions.

Key Developments

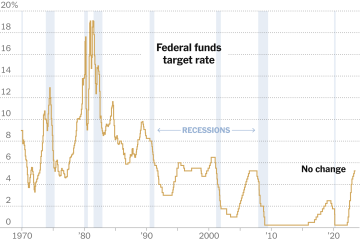

Recently, the Bank of England has faced significant challenges as inflation rates hit a 40-year high, reaching 9.9% in August 2022. In response, the Monetary Policy Committee (MPC) has progressively raised interest rates to combat this inflation, with the benchmark rate reaching 2.25% as of September 2022. These measures are aimed at curbing spending and borrowing to bring inflation back towards its target of 2%.

September 2022 Monetary Policy Update

During the September 2022 MPC meeting, the Bank voted to increase the base rate by 0.5% amidst concerns over persistent inflation and energy price surges, exacerbated by the ongoing geopolitical situation. Governor Andrew Bailey stated, “We are committed to bringing inflation down and will take the necessary steps, even if it means short-term economic pain.” This decision reflects the Bank’s dual mandate to maintain price stability while encouraging growth.

The Bank’s Broader Responsibilities

In addition to managing interest rates, the Bank of England is responsible for maintaining the stability of the UK financial system. This involves overseeing other financial institutions and acting as a lender of last resort. With the increasing complexity of global financial markets, the Bank has also had to adapt its policies and strategies to ensure resilience in the face of economic shocks, such as bank failures or liquidity crises. Its regular assessments and stress tests help ensure that banks and financial firms are well-prepared for potential downturns.

Conclusion

The role of the Bank of England is indispensable in safeguarding the UK’s economic stability. As inflation continues to pose a risk and global uncertainties loom, its policies will need to remain agile and responsive. Looking ahead, achieving a delicate balance between managing inflation and fostering economic growth will be essential for the Bank. For citizens and businesses alike, understanding the actions of the Bank of England will be crucial for navigating the ever-evolving financial landscape.