Understanding the Nikkei 225: Japan’s Premier Stock Index

Introduction

The Nikkei 225, often considered the benchmark index for the Tokyo Stock Exchange (TSE), plays a critical role in shaping economic sentiment and investment decisions, both in Japan and globally. Comprising 225 of the largest publicly traded companies in Japan, the index is a barometer of the country’s economic health and investor confidence. Understanding its movements and influences is essential for investors, analysts, and anyone interested in the dynamics of the Asian financial markets.

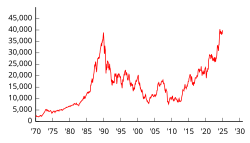

Recent Performance of the Nikkei 225

In recent weeks, the Nikkei 225 has witnessed significant fluctuations, closely mirroring global economic developments and geopolitical tensions. As of mid-October 2023, the index has shown a slight upward trend, with a year-to-date increase of approximately 12%. The gain can be attributed to strong corporate earnings, a weakened yen boosting export-related companies, and continued government support in the form of monetary policies aimed at stimulating growth.

Notable companies within the index, such as Sony, Toyota, and SoftBank, have reported better-than-expected quarterly results, lending further strength to the index. However, experts caution that external factors such as changes in U.S. interest rates, trade relations, and regional stability in Asia could pose risks to this growth. Moreover, recent data from the Bank of Japan indicates that inflation rates are beginning to rise, which might influence future policy decisions.

Market Sentiment and Economic Indicators

The overall investor sentiment regarding the Nikkei 225 remains positive, buoyed by ongoing structural reforms and a focus on digital transformation within Japanese corporations. Moreover, economic indicators suggest that Japan’s economy is gradually recovering from the pandemic’s impacts, supported by resilient consumer spending and robust manufacturing output.

Conclusion

The Nikkei 225 serves not only as a reflection of the Japanese economy but also as an indicator for the broader Asian markets. As we move toward the end of 2023, investors and analysts must remain vigilant to market trends and economic indicators that could influence the index’s trajectory. With potential domestic challenges such as rising inflation and global uncertainties, forecasts for the Nikkei 225 suggest a cautious yet optimistic outlook. Staying informed about these developments will be crucial for anyone looking to navigate the investments in Japan’s dynamic market landscape.