Understanding the Nikkei 225: Its Importance in Financial Markets

Introduction

The Nikkei 225 is Japan’s premier stock market index, representing the performance of the Tokyo Stock Exchange’s top 225 companies. It serves as a vital indicator of the economic health and investor sentiment in Japan. Given the growing integration of global markets, fluctuations in the Nikkei 225 are closely monitored by investors worldwide, making it essential for individuals and institutions to understand its movements and meanings.

Current Trends and Developments

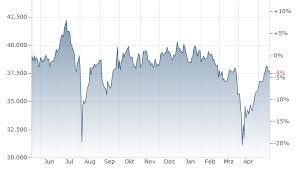

As of late October 2023, the Nikkei 225 has shown some notable fluctuations. The index saw a rise of approximately 1.2% over the past month, buoyed by strong corporate earnings reports and positive economic data. Analysts attribute this growth to the performance of major firms, particularly in the electronics and automotive sectors, which have benefitted from increased global demand and innovations in technology.

On the flip side, external factors, such as rising oil prices and fluctuations in the US dollar, have prompted concerns among investors. A recent report indicated that while Japan’s economy is resilient, ongoing geopolitical tensions and global inflationary pressures could pose risks to future growth. As such, strategic responses from the Bank of Japan remain a topic of discussion.

Factors Influencing the Nikkei 225

The Nikkei 225 is influenced by a myriad of factors, both domestic and international. Among the primary drivers are interest rates set by the Bank of Japan, shifts in fiscal policies, and global trade dynamics. Additionally, foreign investment trends significantly impact the index, as overseas investors account for a considerable portion of the trading volume on the Tokyo Stock Exchange.

Recent data has shown that Japanese exports, particularly in technology and machinery, have surged, contributing positively to the index. The government’s commitment to structural reforms and sustainability has also been viewed as a positive signal for the long-term outlook of the Nikkei 225.

Conclusion

The Nikkei 225 remains a crucial barometer of Japan’s economic landscape and global financial trends. Investors are advised to remain vigilant, considering both the opportunities presented by Japan’s market strengths and the potential risks due to global economic pressures. With the ongoing monitoring of economic indicators and corporate performance, the trajectory of the Nikkei 225 will continue to be of significant interest to analysts and investors alike.