Understanding the Latest Stamp Duty Changes in the UK

Introduction to Stamp Duty Changes

Stamp duty, a significant cost factor for home buyers in the UK, has undergone considerable changes recently. As housing prices continue to fluctuate, these alterations aim to alleviate financial burdens on home buyers and stimulate the property market. Understanding these changes is critical for prospective homeowners and investors alike, as it can have a profound impact on affordability and purchasing decisions.

Recent Changes to Stamp Duty

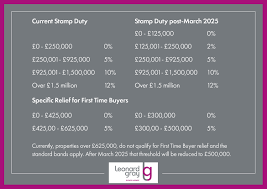

In September 2023, the UK government announced a series of amendments to the stamp duty regulations, primarily affecting first-time buyers and those purchasing properties in specific regions. The key change introduced was the increase in the threshold for stamp duty exemption from £300,000 to £425,000 for first-time buyers. This adjustment is expected to benefit a significant number of individuals entering the property market, easing the financial stress associated with purchasing a home.

Additionally, the government has adjusted rates for property purchases above the standard threshold. For example, properties valued between £425,000 and £625,000 will now attract a reduced rate, while those above £625,000 will incur the standard rate based on the property’s value. The aim is to simplify the taxation process while offering some relief to those in competitive markets where house prices have surged.

Impact on Home Buyers

The new stamp duty regulations are expected to have a mixed impact on the housing market. For first-time buyers, the increase in the exemption threshold will provide greater access to the market, potentially resulting in a surge of first-time purchases. Property experts suggest that this could lead to a revitalisation of segments of the housing market previously stagnated by high costs.

Conversely, there are concerns that such changes could lead to price inflation as sellers may increase asking prices in response to the new regulations. Moreover, existing homeowners looking to downsize or move may face challenges finding affordable properties amidst this shifting landscape.

Conclusion and Future Outlook

As the stamp duty changes take effect, their long-term impact will depend largely on how the housing market responds. Economists remain divided on the potential outcomes; while some foresee positive stimulation of the housing sector, others warn of potential inflationary effects on property prices. For prospective buyers and investors, staying informed about these regulations and market trends will be key to navigating the current landscape successfully.

In conclusion, the recent stamp duty changes are a significant development in the UK housing market, aiming to make home ownership more accessible. Stakeholders should keep a close watch on these trends to adapt to an evolving market environment.