Understanding the Implications of the OBR Verdict

Introduction

The Office for Budget Responsibility (OBR) recently delivered its verdict on the UK’s economic outlook, a pivotal moment that holds significant weight for the nation’s fiscal policies. Established in 2010, the OBR’s role is to provide independent economic forecasts and assess the government’s fiscal strategies, making its verdict crucial for lawmakers, businesses, and the public alike.

Key Findings of the OBR Verdict

The OBR’s latest report highlights several critical aspects of the UK economy. Firstly, it projects economic growth for the next few years, forecasting a modest growth rate of around 1.5% annually. This growth is driven by a rebound in consumer spending and an uptick in business investment, spurred on by easing inflation rates, which are expected to fall to around 3% by the end of 2024.

Moreover, the OBR has warned about potential challenges such as ongoing global supply chain disruptions and uncertainties surrounding post-Brexit trading conditions. These issues could impede growth and require careful navigation from policy-makers.

The Fiscal Implications

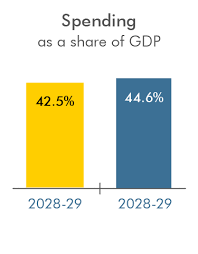

Following the OBR’s projections, Chancellor Jeremy Hunt is likely to face tough choices regarding public spending and taxation. The verdict suggests that while the economy is on a recovery path, the fiscal space remains constrained due to previous levels of debt accrued in response to the pandemic. Public debt currently stands at £2.5 trillion, making up around 100% of GDP, which raises questions about long-term sustainability.

The OBR has thus urged the government to focus on measures that enhance productivity and potential GDP, rather than short-term fixes. Continuation of investment in infrastructure and skills training is highlighted as essential for long-term economic health.

Conclusion

The recent OBR verdict delivers an essential insight into the economic landscape of the UK, underscoring both opportunities for growth and potential pitfalls. For UK citizens and businesses, this report serves as a bellwether for future tax policies and public spending decisions. As the government prepares to respond to the OBR’s findings, the implications of these forecasts will likely be felt broadly across various sectors, shaping economic conditions for years to come. Observers will closely monitor how effectively the government balances growth ambitions with fiscal responsibility in a changing economic climate.