Understanding the HSBC Share Price Movements

Introduction

The share price of HSBC Holdings plc, one of the world’s largest banking and financial services organisations, is always of significant interest to investors and analysts alike. Given the bank’s substantial global footprint, any fluctuations in its share price can have a ripple effect across financial markets. As of October 2023, understanding the factors influencing HSBC’s share price is particularly relevant amid ongoing economic recovery efforts post-pandemic and geopolitical tensions.

Recent Trends in HSBC Share Price

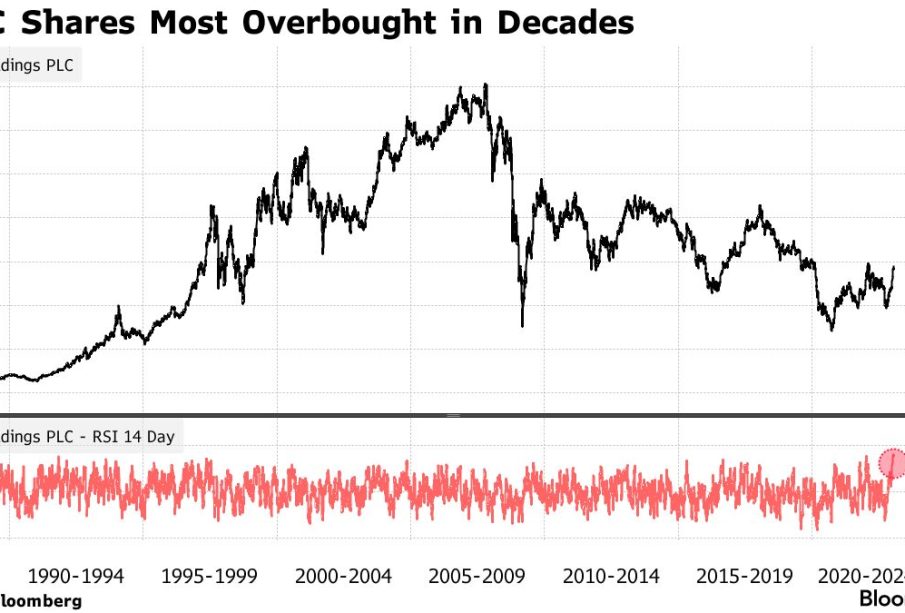

As of mid-October 2023, HSBC shares have seen volatility influenced by various factors including interest rate changes, economic forecasts, and operational updates from the bank itself. Following a strong performance in the first half of the year, where HSBC reported impressive profits driven by higher interest rates, many analysts were optimistic about its future trajectory. However, recent market conditions and expectations of potential interest rate hikes have introduced uncertainty.

On October 10, 2023, HSBC’s share price was reported at £6.30, reflecting a slight decrease compared to the previous week. Market analysts attribute this decrease to investor caution amidst rising inflation concerns and geopolitical instability. The broader financial services sector is experiencing similar patterns, with many banks facing similar pressures.

Impacts of Economic Indicators

Economic indicators play a crucial role in shaping the perceptions of HSBC’s share performance. For instance, data releases regarding inflation rates and employment figures can significantly sway investor sentiment. Recent reports suggested a steady inflation rate which initially buoyed prices, but ongoing uncertainty linked to global supply chain disruptions has made investors wary.

Future Outlook for HSBC Shares

Looking ahead, analysts remain divided. Some foresee further share price growth driven by HSBC’s strategic focus on Asia and its efforts to diversify revenue streams. Others caution that without a resolution to economic instability, HSBC’s shares may see continued pressure. It is also important to monitor the bank’s upcoming earnings report scheduled for early November, which will provide key insights into its performance and direction moving forward.

Conclusion

In conclusion, the HSBC share price is influenced by a myriad of factors including global economic conditions, central bank policies, and geopolitical events. For investors, staying informed about market trends and HSBC’s operational changes is essential for making informed decisions. As HSBC navigates through these current challenges, its share price will continue to reflect both the bank’s performance and broader economic conditions, making it a key indicator within the financial sector.