Understanding the Hang Seng Index: Trends and Insights

Introduction to the Hang Seng Index

The Hang Seng Index (HSI) is one of the leading stock market indices in Asia, reflecting the performance of the largest companies listed on the Hong Kong Stock Exchange. Comprising 50 major companies, it serves as a barometer for the Hong Kong economy and, by extension, the broader Asian market. Understanding the HSI is crucial, especially for investors and financial analysts, as it provides insights into market trends, economic conditions, and investor sentiment.

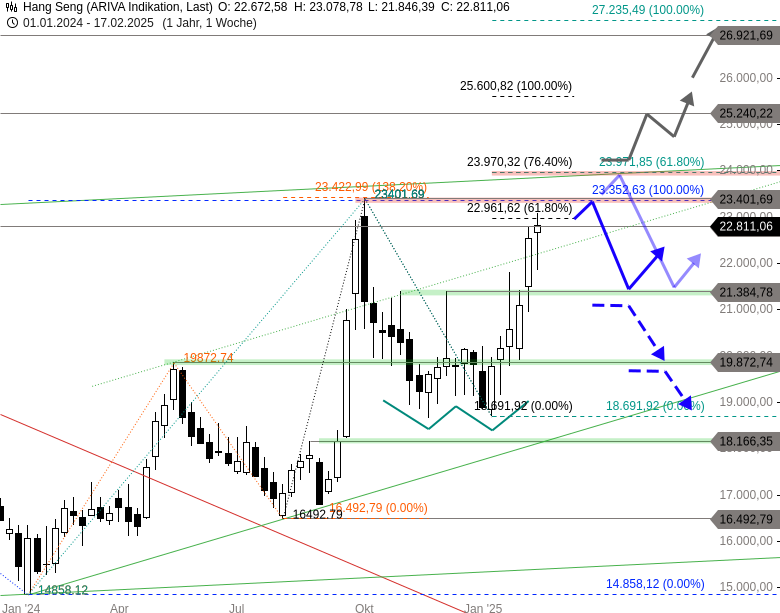

Current Trends in the Hang Seng Index

As of October 2023, the Hang Seng Index has experienced a mix of volatility and growth, driven by various global and local factors. Following a year of economic uncertainty brought on by rising interest rates and inflation concerns, the index saw a rebound in mid-2023, partly due to robust corporate earnings and a stabilising economy in China. Recent data indicates that the HSI has increased approximately 15% since the beginning of the year, showcasing the resilience of the Hong Kong market amidst global economic challenges.

Investor sentiment has improved, supported by the Chinese government’s stimulus measures aimed at bolstering consumer spending and lifting businesses. Additionally, significant tech firms listed on the index, such as Alibaba and Tencent, have reported better-than-expected earnings, contributing to overall index growth.

Economic Impact and Future Forecasts

The performance of the Hang Seng Index is significant not just for local investors but also for global market participants. As it reflects economic health in Hong Kong and China, movements in the index can influence investor decisions worldwide. Analysts are optimistic about the HSI’s potential to reach new heights, provided that the global economy continues to stabilise and inflation rates remain manageable.

Despite these positive indicators, challenges remain. Ongoing geopolitical tensions, potential regulatory changes in the tech sector, and the uncertainty surrounding China’s economic recovery may pose risks to the index’s future performance. Investors are advised to stay informed and consider these variables when making decisions related to the Hang Seng Index.

Conclusion

In conclusion, the Hang Seng Index stands as a vital component of the financial landscape in Hong Kong and serves as a significant indicator of the overall health of the Asian markets. As trends evolve and new challenges arise, both local and international investors will keenly watch its movements to gauge sentiment and economic prospects. Understanding these dynamics is essential for navigating the complexities of investment opportunities in this influential market.