Understanding the Hang Seng Index and Its Implications

Introduction to the Hang Seng Index

The Hang Seng Index (HSI) holds significant importance in evaluating the Hong Kong stock market, making it a crucial topic for investors and analysts globally. It is widely regarded as the benchmark index for the Hong Kong equity market, comprising the largest and most liquid companies listed on the Hong Kong Stock Exchange. Monitoring the HSI provides insights into market trends, investor sentiment, and broader economic conditions in Hong Kong.

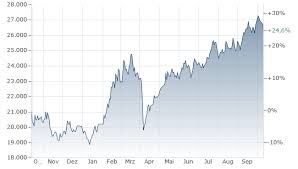

Recent Performance of the Hang Seng Index

As of October 2023, the Hang Seng Index has witnessed notable fluctuations, reflecting the complexities of both local and global economic dynamics. After a tumultuous first half of the year, where geopolitical tensions and inflationary pressures impacted investor confidence, the HSI has seen a recovery phase with a surge of approximately 8% in the third quarter. Key factors contributing to this resurgence include positive earnings reports from major companies, easing of some regulatory pressures, and a generally improved outlook for the Chinese economy.

Key Drivers of the Hang Seng Index

Several critical industries contribute to the performance of the Hang Seng Index. The technology sector, which includes prominent companies like Tencent and Alibaba, plays a significant role due to its substantial market capitalisation. Furthermore, the financial sector’s robustness, driven by banks such as HSBC and Standard Chartered, continues to impact the overall index performance. Recent data indicates that these sectors are poised for growth, creating a more optimistic environment for investors.

Global Influences on the Hang Seng Index

The performance of the Hang Seng Index doesn’t exist in isolation; it is heavily influenced by global trends, especially those emerging from the United States and mainland China. Economic data releases from the US, such as inflation rates and interest policies, tend to reverberate through global markets, including Hong Kong. Moreover, any developments regarding China’s economic recovery post-COVID-19 play a crucial role in shaping the market sentiment in Hong Kong.

Conclusion and Future Outlook

Looking ahead, analysts remain cautiously optimistic about the Hang Seng Index. The anticipated reopening of China’s economy, alongside potential further easing of local regulatory measures, could spur growth in both consumer spending and corporate investment. However, uncertainties regarding global economic conditions and ongoing geopolitical tensions suggest that investors should stay vigilant. Understanding the trends and underlying factors influencing the Hang Seng Index will be essential for making informed investment decisions in the near future.